NEW YORK--(BUSINESS WIRE)--Aug 23, 2023--

Citi’s U.S. Retail Bank introduces simplified banking, a more straightforward way of banking. By retiring account packages and introducing Relationship Tiers, Citi is streamlining its benefits and services and enhancing the customer experience. New customers can benefit from these changes immediately and Citi will begin converting existing customers to simplified banking in 2024.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20230822549472/en/

(Graphic: Business Wire)

“Customers are at the heart of everything we do, and we are excited to offer even more enhanced offerings with convenient benefits and services that grow with customers as they move through life’s stages,” said Craig Vallorano, Head of Retail Banking at Citi. “These latest changes are designed to create a more seamless experience for our customers and make it easier for them to get personalized advice and access their finances.”

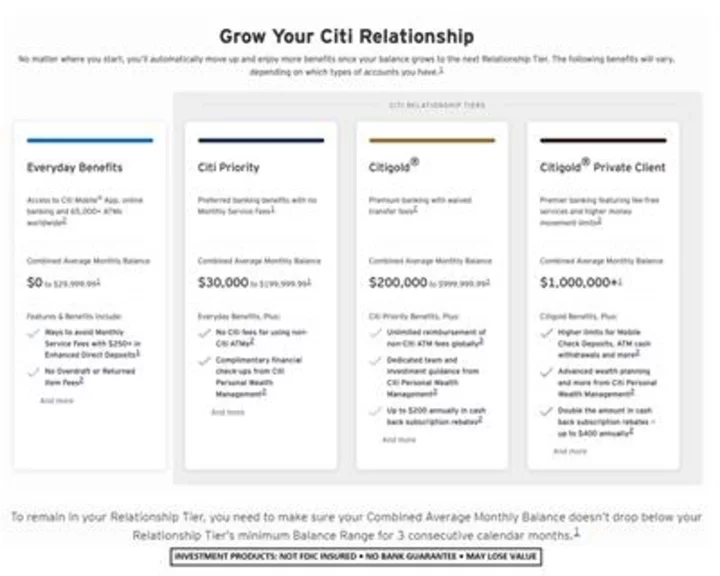

Introducing Relationship Tiers

Similar to an airline or hotel rewards program, as a customer’s Combined Average Monthly Balance grows, clients may unlock Relationship Tiers, allowing access to more benefits and services from Citi Priority, Citigold® or Citigold® Private Client. Relationship Tiers will allow access to enhanced Citi benefits and services including waived Monthly Service Fees on checking and savings accounts, waived Citi fees at non-Citi ATMs, professional financial planning and much more. Citi will automatically link a customer’s eligible deposit and investments accounts to provide a Combined Average Monthly Balance that will place them in the appropriate Relationship Tier.

Terms and conditions apply. For full details, please visit:citi.com/simplifiedbanking.

Streamlined Fees

Citi is expanding on its commitment to make banking more accessible and inclusive for people across the income spectrum. Customers not in a Relationship Tier can avoid Monthly Service Fees in their Citi Checking account by making Enhanced Direct Deposits of $250 or more each month; in their Citi Savings account by having $500+ or more in Average Monthly Balance or owning both a Citi Checking and Savings account; and during the month they open an account and for three calendar months after account opening. Since summer 2022, Citi has defined Enhanced Direct Deposits to include deposits via Zelle® and other peer-to-peer payments when made via the Automated Clearing House using providers such as Venmo or PayPal. This policy helps to remove a barrier that workers may face who primarily receive income through peer-to-peer payments.

Beginning in 2022, Citi has eliminated a number of its retail consumer banking fees, including overdraft fees, returned item fees, and overdraft protection fees with plans to remove additional retail banking fees in the coming months.

Offering Industry Leading Family Linking

Citi is making family financial management simpler and more convenient by enhancing Family Linking. When customers enroll in Family Linking, they can unlock higher Relationship Tiers and access their benefits faster by combining average monthly balances with those of eligible family members who live with them in the same household. In addition, customers do not need a joint deposit account to share benefits with family members, so they can enjoy the perks of Family Linking while maintaining their own financial freedom.

Existing customers can learn more and get early access to simplified banking at citi.com/earlyaccess, on the Citi Mobile® App, or by speaking with a Citi banker. Visit citi.com/simplifiedbanking to learn more about the newest benefits of banking with Citi. Depository products offered by Citibank, N.A. Member FDIC.

About Citi

Citi is a preeminent banking partner for institutions with cross-border needs, a global leader in wealth management and a valued personal bank in its home market of the United States. Citi does business in nearly 160 countries and jurisdictions, providing corporations, governments, investors, institutions and individuals with a broad range of financial products and services. Additional information may be found at www.citigroup.com | Twitter: @Citi | LinkedIn: www.linkedin.com/company/citi | YouTube: www.youtube.com/citi | Facebook: www.facebook.com/citi.

View source version on businesswire.com:https://www.businesswire.com/news/home/20230822549472/en/

Colin Wright, Citi Global Communications,colin.wright@citi.com

KEYWORD: NEW YORK UNITED STATES NORTH AMERICA

INDUSTRY KEYWORD: BANKING PROFESSIONAL SERVICES FINANCE

SOURCE: Citi

Copyright Business Wire 2023.

PUB: 08/23/2023 08:00 AM/DISC: 08/23/2023 08:01 AM

http://www.businesswire.com/news/home/20230822549472/en