Cisco Systems Inc., the largest maker of computer networking equipment, plunged in late trading after giving a disappointing forecast, adding to concern that corporations are reining in their technology spending.

Sales will be $12.6 billion to $12.8 billion in the period ending in January, the company said in a statement Wednesday. That was far short of the $14.2 billion analysts had estimated. Excluding certain items, profit will be 82 cents to 84 cents a share, compared with a prediction of 99 cents.

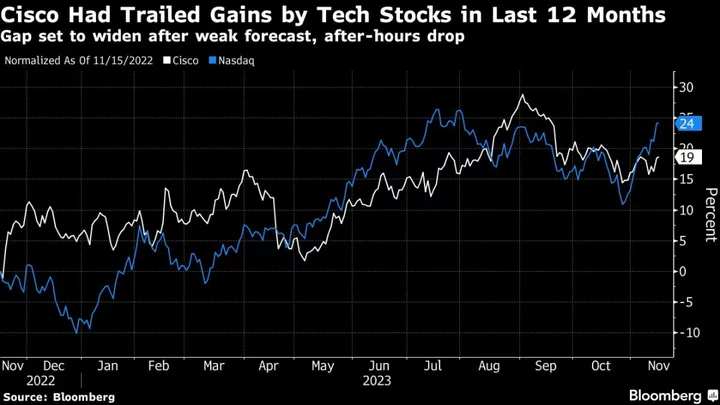

The shares tumbled as much as 16% in extended trading following the announcement, before recovering somewhat to an 11% drop. They had climbed 12% in 2023 to close at $53.28 on Wednesday.

Cisco’s report shows that slowing orders for networking hardware are taking their toll on growth. Chief Executive Officer Chuck Robbins is trying to lessen his company’s dependency on one-time sales of equipment by pushing deeper into software and services, such as security. But that transition isn’t complete enough to cushion Cisco from declines in corporate spending budgets.

Robbins said that the macroeconomy hasn’t weakened. The order slowdown — a 21% decrease in the first quarter — was largely fueled by customers taking a break from new orders to install gear they’ve already received.

“It might have been easier for me to say it was macro — we didn’t see it get materially worse in the quarter,” Robbins said on a conference call with analysts. “We really unloaded our backlog in the last sixth months, and it was billions of dollars more of equipment than we would normally ship.”

The company projected that the weak environment for orders will linger, estimating that “there are one to two quarters of shipped product orders still waiting to be implemented by its customers.”

Still, the company expressed hope that sales would pick up again in the back half of the year.

“After customers implement large amounts of recently shipped product, we expect to see product order growth rates accelerate in the second half,” Chief Financial Officer Scott Herren said in the statement.

Cisco is attempting to further diversify its business by acquiring data-crunching software maker Splunk Inc. for $28 billion, a deal announced in September. The transaction will give Cisco more services to sell to corporate customers, including ones that monitor network health and cybersecurity risks.

The company expects to close that deal by the end of the third quarter of calendar 2024.

Read More: Cisco to Buy Splunk for $28 Billion in Giant AI-Powered Data Bet

Cisco’s adjusted gross margin — the percentage of sales remaining after deducting the cost of production — is expected to be 65% to 66% this quarter. That’s in line with estimates.

Sales will be $53.8 billion to $55 billion in fiscal 2024, down from a previous range of as much as $58 billion, the San Jose, California-based company said. That compares with the roughly $58 billion analysts had estimated on average, according to a Bloomberg survey.

In Cisco’s fiscal first quarter, which ended Oct. 28, revenue rose 8% to $14.7 billion. Profit was $1.11 a share, minus some items. That compares with estimated revenue of $14.6 billion and earnings of $1.03 a share.

It was the third strong quarter in a row, and that’s had an effect on the forecast, said Herren, Cisco’s finance chief.

“Let’s not totally forget we had a fantastic quarter,” he said in an interview. “That helps explain the position we’re in right now. The bottleneck has shifted downstream.”

Cisco also emphasized that it’s benefiting from spending on artificial intelligence systems. The company said it’s winning orders from large companies building up their infrastructure to handle more AI computing. It now has about $1 billion of worth of such orders, double where it was three months ago.

Herren said the company is making progress in its bid to generate more software and services revenue. Some 44% of its sales now come from recurring sources and that total is increasing, he said. The Splunk acquisition will be a “big help” in raising that portion higher, he said.

(Updates with additional executive comments starting in fifth paragraph.)