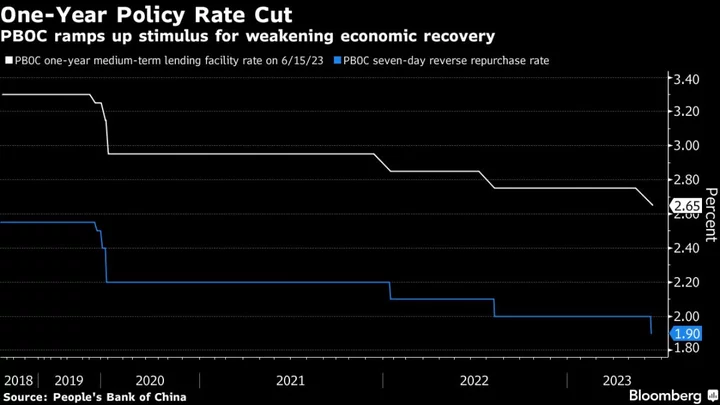

China’s weakening economy prompted the central bank to cut interest rates for the first time since August, and expectations are growing for more stimulus targeted at ailing industries including the property sector.

The People’s Bank of China reduced the rate on its one-year loans on Thursday after lowering short-term rates earlier this week. Official data showed a slump in real estate, a worrying decline in business investment and record joblessness among young people.

The mounting evidence of a downturn has Beijing shifting toward rolling out more stimulus to help the economy. The State Council is expected to discuss a broad package of stimulus proposals for sectors including property, Bloomberg News reported earlier this week. The PBOC could cut interest rates further this year and give banks a cash boost so they can keep lending, economists say.

Measures to boost consumption — including those to promote the development of the car, home appliance and catering industries — are in the works, a commerce ministry spokesperson said Thursday at a regular briefing.

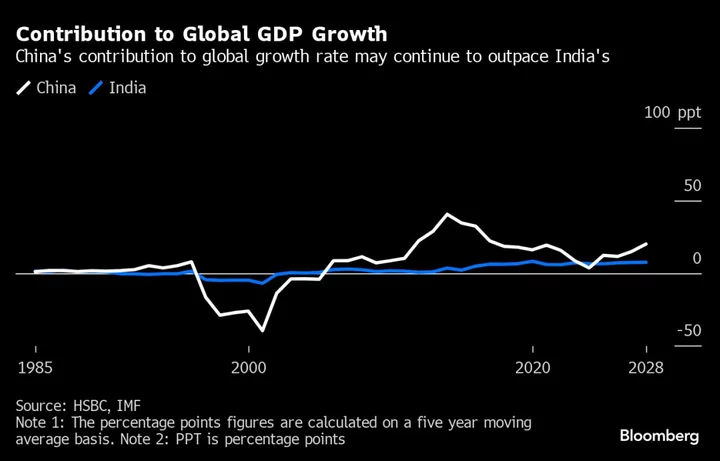

Even so, stimulus is likely to be limited in scope compared with past downturns. Beijing is still on track to meets its relatively conservative growth target of around 5% for this year, while high debt levels in the economy and worries about financial stability mean officials are reluctant to overstimulate the property sector.

“Stimulus is likely to be measured,” said Ding Shuang, chief economist for Greater China and North Asia at Standard Chartered Plc. “We see the PBOC’s policy rate cut this week as a clear signal of policy easing, intended to prevent the negative sentiment from fanning itself.”

Other measures are likely to follow, Ding said, including “targeted support to the housing sector, increase in policy bank lending, and possibly additional local special bond issuance quota.”

Expectations for more stimulus lifted markets. The CSI 300 Index closed 1.6% higher on Thursday, the most since February, while the yuan was the best-performing emerging-market currency in Asia.

The National Bureau of Statistics said the foundation of the economy’s recovery “is not yet solid,” and focus needs to be on repairing and expanding demand.

The unemployment rate remained relatively elevated at 5.2% in May, while the jobless rate for young people between the ages of 16 and 24 rose slightly to 20.8%, a new record high since data became available in 2018.

The housing market remains a major drag on growth. Property investment contracted 7.2% in the first five months of the year from the same period in 2022, worse than expected. Construction of new homes plunged more than 22% in the period. Home prices rose just 0.1% month-on-month in May, down from 0.3% in April.

“In order to restore confidence, there would need to be a lot more policies to follow up, particularly in the property sector,” said Zhang Zhiwei, chief economist at Pinpoint Asset Management Ltd. “That’s probably the most important sector.”

Infrastructure investment remains one of the few bright spots, accelerating to an 8.8% gain in May from a year ago, according to Nomura Holdings Inc. estimates. That may reflect a marginal pick-up in funding for government-led entities, the Nomura economists wrote in a research note.

What Bloomberg Economics Says ...

An undershoot in retail sales showed the consumption recovery lost more momentum. A sharper-than-expected slowdown in fixed asset investment showed sinking private spending, particularly in the property sector, is overwhelming government stimulus in the form of outlays on big projects.

Chang Shu and David Qu

For the full report, click here

The PBOC timed its easing just as the Federal Reserve paused its rate-hiking cycle for the first time in 15 months, while still signaling further tightening ahead. The widening gap between US and Chinese rates have fueled capital outflows and put pressure on yuan, which is down more than 3% against the dollar this year.

The PBOC also provided 237 billion yuan ($33 billion) of medium-term loans, more than the 200 billion yuan maturing in June. The cut to the one-year MLF rate was largely expected after a key short-term rate was reduced by the same magnitude on Tuesday. The two rates are usually adjusted together.

The signal from the PBOC “is very important because it’s a reversal of policy direction,” Dong Chen, head of Asia macroeconomic research at Pictet Wealth Management, said in an interview on Bloomberg TV. “Now policymakers have to press the gas pedal a lot harder. In the near term, we need continuous monetary and fiscal support.”

Barclays Plc forecasts a 10 basis-point reduction in policy rates each quarter through the beginning of next year, while Nomura expects two more 10-point rate cuts in the second half of this year. Macquarie Group Ltd. sees another 10-point cut in the MLF rate and a 25-point reduction in the reserve requirement ratio in the third quarter.

The State Council could discuss the stimulus measures as soon as Friday, according to people familiar with the discussions, although it’s unclear when the measures will be announced or implemented. The Economic Daily also said in a front-page commentary on Thursday that China needs to take further steps to support the economy, including maintaining strong fiscal spending.

“The biggest question is the general sentiment — households are saving more and corporations are not investing as much, because they are not certain about the future,” said Gary Ng, senior economist at Natixis SA. “Even if the central bank adopts more lax monetary policy now, it may not be too successful, because it ultimately depends on the general sentiments.”

--With assistance from Tania Chen, Jiyeun Lee and Yihui Xie.

(Updates with additional details.)