China’s state-owned property developers are warning of widespread losses, fueling concerns that the housing crisis is expanding from the private sector to companies with government backing.

Eighteen out of 38 state-owned enterprise builders listed in Hong Kong and the mainland reported preliminary losses in the six months ended June 30, up from 11 that warned of full-year losses in 2022, according to a Bloomberg tally based on corporate filings. Two years ago, only four firms with controlling or major state shareholdings posted losses.

The warnings signal state builders are no longer immune from the two-year housing slump that has weakened the economy and triggered dozens of defaults by private peers, with speculation that Country Garden Holdings Co. may be next. It also dims the ability of SOEs to support the market by taking over incomplete projects to ensure they are delivered to homebuyers.

“China’s property slowdown is already hurting all developers, including the large government-linked ones,” said Zerlina Zeng, senior credit analyst at CreditSights Singapore. “We do not expect the situation to materially improve in the second half.”

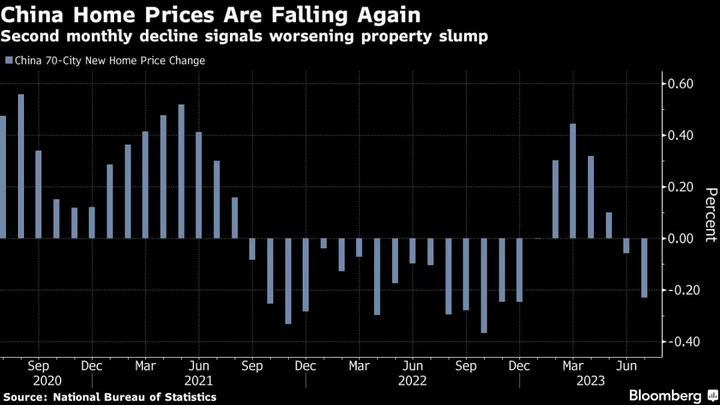

In their warnings, some of the state-owned developers cited declining gross profit margins and heavier provisions to write down asset values stemming from the housing woes. New-home prices fell for a second month in July, government figures showed this week, and Bloomberg reported the situation is even worse than the official data show.

Companies seeing losses include some of the biggest developers owned by the central government. Shenzhen Overseas Chinese Town Co. warned of a loss of as much as 1.7 billion yuan ($233 million), partly due to a marketing strategy to speed up home sales. That followed a loss in the second half of last year, which was its first since its 1997 listing.

Players in economically stronger cities are also suffering. Everbright Jiabao Co., operated by a local state asset manager in Shanghai’s Jiading district, said it expects its first ever half-year loss since its listing.

Still, the loss warnings aren’t necessarily all doom and gloom for state developers, according to Bloomberg Intelligence credit analyst Andrew Chan, who says it’s natural that they would write down their inventories to reflect the slump in values.

“SOEs could be kitchen-sinking their results for better years ahead,” Chan said. “The key is whether they can still receive liquidity support from banks. For smaller SOE developers, it will be a case-by-case situation.”

But losses will reduce their scope to take on unfinished projects left by defaulted private-sector firms, further denting homebuyer sentiment. Chinese regulators see asset sales as a key step to easing the debt crisis, as President Xi Jinping’s government largely steers clear of direct bailouts.

“Sector consolidation anyhow takes time,” CreditSights’ Zeng said. “Especially in a property downturn when acquirers, such as SOEs and asset management firms, are demanding better valuations and sellers are not willing to dispose at a deep discount.”

--With assistance from Irene Huang.