China will provide emergency funding to heavily indebted local governments as needed, central bank Governor Pan Gongsheng said — comments that underscore the importance authorities place on the problem.

“When it’s necessary, the People’s Bank of China will provide emergency liquidity support to regions with a relatively heavy debt burden,” Pan said in a speech at the Financial Street Forum in Beijing on Wednesday.

Financial regulators have worked with other authorities to resolve debt risks at the local level this year, Pan said. He added that government debt levels are at a mid- to low level compared to other nations.

Pan also said the few provinces where smaller banks face higher financial risks were were drafting plans to resolve the matter. They will use various channels to replenish capital for the lenders, he said.

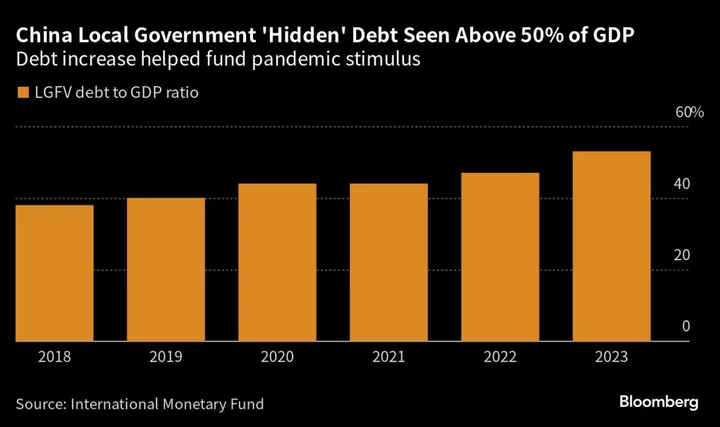

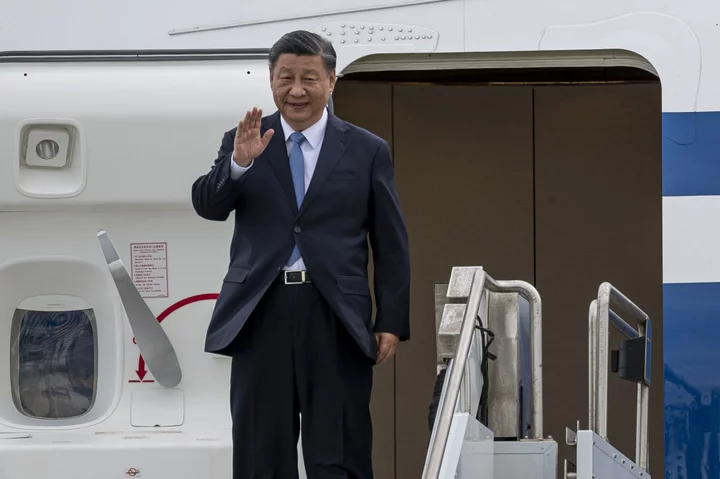

China has been attempting to defuse risks from its large pile of off balance-sheet local government debt, without resorting to major bailouts. That’s a difficult task for President Xi Jinping’s government as it faces a fragile economic recovery hindered by a property slowdown.

See: China Vows Enduring Local Debt Cleanup at Key Policy Meeting

At a recent twice-a-decade policy meeting attended by Xi, China vowed to set up a long-term mechanism to resolve debt risks tied to local authorities and signaled willingness to expand central government borrowing.

Beijing has over the past year asked the nation’s largest banks to shoulder some of the responsibility by providing support to troubled developers as well as local government financing vehicles, which sit on a $9 trillion pile of debt. Fulfilling those duties is likely to hurt their profit-margins.

China’s regional banks could incur a capital hit of 2.2 trillion yuan ($301 billion) from their LGFV debt, S&P Global Ratings warned last month in a research note. In “a downside scenario,” about a fifth of the regional lenders, which held about $15.6 trillion of assets as of end-2022, could sink below the minimum regulatory capital adequacy ratio of 8% and require recapitalization, S&P added.

Local governments could ask local asset management firms to help acquire bad debt but those with fewer financial resources will face increasing challenge to contain the risks, Fitch Ratings Inc. said in a report last month.

It added that the government may resort to “more unconventional approaches” to handle the pressure banks face over asset quality.

In his remarks on Wednesday, Pan said efforts to resolve local debt issues have included pushing for regional governments to make repayments by selling assets, curbing new investment projects in debt-laden regions and guiding financial institutions to extend or replace existing debt while curbing new lending.

Regulators have also supported LGFVs to transform into market-based, self-sustainable enterprises, Pan added.

He also vowed to satisfy the financing need of all types of developers regardless of whether they’re private or state-owned. The spillover impact on the financial system from the real estate market’s correction is generally manageable, he said.