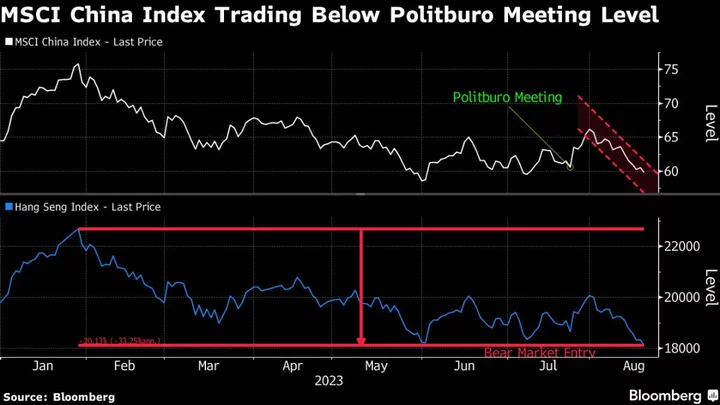

Some of China’s biggest banks lowered rates on a range of deposit products, responding to the government’s call for help in boosting growth in the world’s second-largest economy.

Industrial & Commercial Bank of China Ltd. and Agricultural Bank of China Ltd. lowered rates on three-year and five-year deposits by 15 basis points to 2.45% and 2.5%, respectively, and annualized rates for demand deposits to 0.2% from 0.25%, according to their websites. Bloomberg News reported on the size of the cut earlier.

The changes, which come into effect Thursday, will also see two-year deposit rates drop by 10 basis points to 2.05%.

The move followed a call by Chinese authorities earlier this month for the nation’s biggest banks to cut their deposit rates for at least the second time in less than a year. The shift will help ease deteriorating margins as lenders are also being urged to provide cheap loans to small businesses and home buyers.

Major banks including ICBC and AgriBank last trimmed their deposit rates in September for the first time since 2015. Commercial lenders have had some leeway in setting their own rates since the central bank scrapped direct control in 2005. The PBOC, however, maintains substantial sway by setting a ceiling and floor for rates through the interest rate self-disciplinary body.

China’s economic recovery lost momentum in April. Chinese exports fell for the first time in three months in May, adding to risks in the economy as global demand weakens. Economists surveyed by Bloomberg expect gross domestic product to expand 5.5% this year, edging down from a prior estimate of 5.6%. Home sales growth also slowed in May after a brief rebound.

Speculation is growing that Beijing may have to deliver more stimulus to bolster growth. Some economists expect the central bank to cut the reserve requirement ratio for banks in coming months.

The deposit rate cuts would lower costs of banks, enabling them to reduce lending rates over time. That, in turn, would make it more attractive for consumers and businesses to borrow. Lower deposit rates would also make it less attractive for consumers to park their cash at banks.

--With assistance from Amanda Wang.