China is turning its focus to rolling out various policy promises to help spur the economy’s recovery as it loses further traction.

Regulators are pushing local governments to speed up bond sales for infrastructure spending, according to a local media report, and the central bank urged banks on Tuesday to cut mortgage rates to revive the struggling property market.

The moves suggest Beijing is keen to pick up the pace of implementing the raft of policy measures announced in recent days to bolster the economy, and follow through on the pro-growth signals from the ruling Communist Party’s Politburo, its top decision-making body, last week. The economy’s post-Covid boom has lost steam, stymied by a property slump, weaker consumer spending, falling exports and soaring youth unemployment.

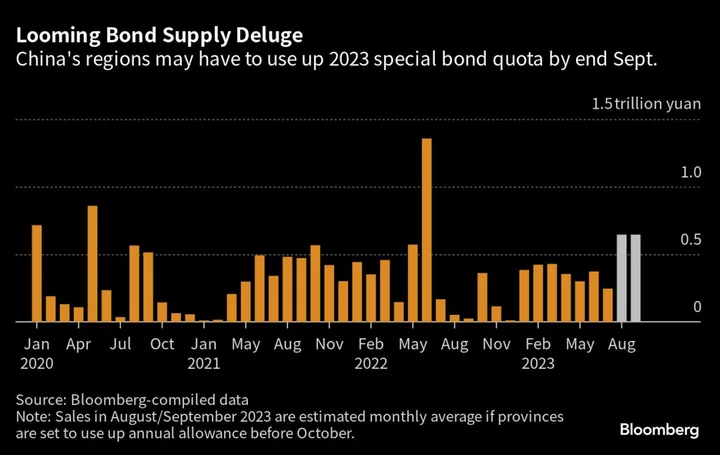

While Beijing has stopped short of providing new fiscal and monetary support, officials are urging local governments to spend more. Regulators have told local governments to use up this year’s special bond quota by the end of September and spend the funds raised before November, the 21st Century Business Herald reported Tuesday, citing unidentified local finance officials and bond underwriters.

A total of 2.36 trillion yuan ($329 billion) of this year’s new special bonds, which are mainly used for infrastructure spending, was sold as of the end of July. That implies an average of 670 billion yuan of the bonds will hit the market in the next couple of months to meet the September deadline, according to the report.

Officials are also turning their focus to reviving the property market after the Politburo signaled more policy easing. The People’s Bank of China said in a statement Tuesday it will guide banks to lower existing mortgage rates, adopting slightly stronger language to push for more lending in the sector.

The policy aims to discourage home owners from repaying their mortgages ahead of schedule. Local lenders have already moved to offer temporary preferential rates on existing mortgages or to renegotiate home loans with borrowers in cities like Guangzhou in the south and Changzhou in the east, since the PBOC first hinted at the policy at a briefing earlier.

On Tuesday, Chifeng in the northern region of Inner Mongolia, loosened rules for homebuyers applying for a government-run mortgage program, according to an announcement from the city’s Housing Fund Management Center.

The Politburo last week also pledged to boost consumption, resolve local government debt, and invigorate the capital market, sparking a rally in Chinese stocks. It also said the issuance of local special bonds and the use of the funding will be accelerated as they take “counter-cyclical” measures to support the economy.

The support measures announced in recent weeks ranged from expanding consumption of products such as cars and home goods, to boosting loans to private businesses and renovating so-called urban villages in the country’s biggest cities.

Investors are betting that regulators will act swiftly on the Politburo’s promises of support after weeks of disappointment over a lack of execution. That’s boosted by optimism over long-awaited policies targeting the country’s biggest cities — though the impact to the physical real estate market will take time.

Chinese shares traded in Hong Kong have gained about 8% since the Politburo meeting. The mainland’s CSI 300 Index of stocks has advanced a bit less than 5%.

The stronger sentiment is helping a push to invigorate capital markets. For foreign investors, continued robust support for the yuan is increasing the attractiveness of Chinese assets and is redirecting stronger flows to equities.

However, economists have cautioned that authorities have stopped short of announcing large-scale stimulus and some of the measures, such as those intended to bolster confidence among private businesses and consumers, will take time to have an effect on growth.

--With assistance from Rebecca Choong Wilkins.