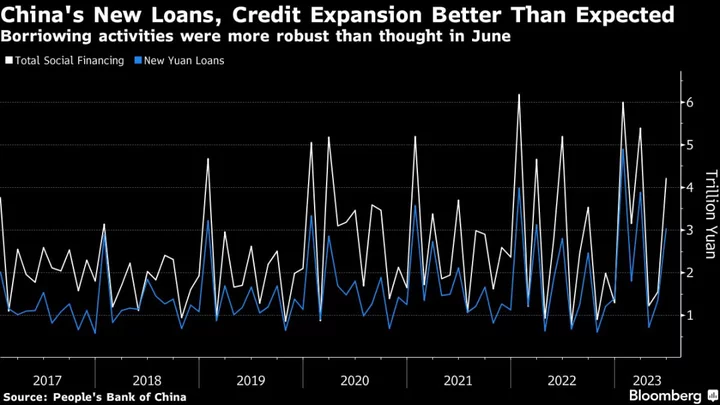

China’s new loans accelerated in June after a central bank interest rate cut in the middle of the month aimed at boosting credit demand.

- Aggregate financing, a broad measure of credit, was 4.2 trillion yuan ($583 billion), the People’s Bank of China said Tuesday. That was higher than the median estimate of 3.1 trillion yuan in a Bloomberg survey of economists, and compares with 5.2 trillion yuan in the same month a year ago.

- Financial institutions offered 3.05 trillion worth of new loans in the month, above economists’ forecasts of 2.3 trillion yuan and compares with the 2.8 trillion yuan a year ago

New corporate medium and long-term loans — which reflect investment demand — improved from a high level recorded in the same month last year. New household mid and long-term loans, a proxy for mortgages, also increased slightly from last year.

“It seems that the government has successfully directed more lending to corporates,” said Michelle Lam, Greater China economist at Societe Generale SA. “The data offers hope that infrastructure investment is now being stepped up to stabilize growth after the drastic slowdown in April and May.”

The figures also provides hope that the economy will see faster sequential growth in the second half of the year after the slump in the second quarter, according to Lam. But infrastructure alone will not be enough given the weak housing market and private-sector confidence, and more easing is still needed to ensure China can comfortably exceed its moderate growth target of around 5% this year, she said.

The better-than-expected result is also likely to be taken with a grain of salt by investors. Banks usually rush to extend loans at the end of each quarter to meet their lending targets, resulting in a spike in credit in certain months including June. The year-on-year growth rate of broad money supply and the stock of credit both slowed from a month ago and point to a deceleration in financing activities.

It is unclear whether the improvement came from a push to increase loans from policymakers or real organic growth, but the economic recovery lost more steam in June despite the rate cut and the jump in lending. Manufacturing activities contracting for the third straight month, while the expansion of the services sector also slowed.

Borrowing demand has been sluggish in recent month, and the interest rates for bankers’ acceptances declined in the last two weeks of the month. That suggests banks were trading more with each other in a bid to boost credit growth and meet their targets for extending loans — a sign of weak credit demand from companies and households.

The PBOC repeated a pledge to maintain “reasonable growth” of credit at a “stable pace” during a monetary policy committee meeting at the end of June. The meeting was attended by Pan Gongsheng, who was appointed party chief of the central bank earlier this month.

Economists expect the PBOC to ease monetary policy further this year to support the economy, with moderate cuts to interest rates and moves to reduce the amount of cash banks must set in reserve. More Chinese people are seeing their incomes drop and expect house prices to fall, according to a recent PBOC survey, underscoring weak consumer confidence.

--With assistance from Fran Wang.