China’s largest banks cut rates for the nation’s $453 billion corporate US dollar deposits for the second time in a matter of weeks, according to people familiar with the matter, as authorities intensify measures to shore up the struggling yuan.

At least nine banks, including the four big state lenders, removed the spread they previously offered over the US Secured Overnight Financing Rate for corporate clients, the people said, declining to be identified discussing privater information. Before the latest reduction, banks were offering 5.7% for one-year deposits, down from 6% about a month ago. The SOFR stands at 5.09%.

Retail investors have seen even bigger reductions. State lenders this week slashed one-year rates on household deposits to about 2.8% from 4.5%-5% earlier. That compares to 1.65% for similar period yuan deposits. Lower deposit rates may help support the yuan by making it less attractive for companies and consumers to convert their cash holdings into dollars.

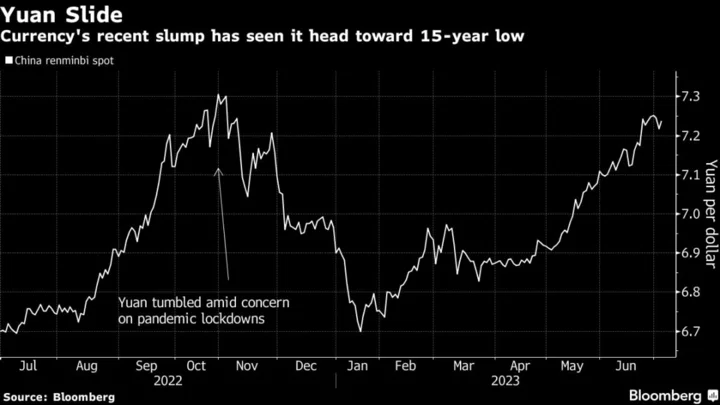

Chinese authorities are stepping up efforts to stabilize the nation’s currency after it dropped toward the lowest level in 15 years against the greenback amid concern about the strength of the economic recovery. While other major economies have been raising benchmark interest rates, China cut policy interest rates last month for the first time in nearly a year, signaling looser monetary policy.

Banks have limited room to further lower the deposit rate for corporate clients due to the risk companies will shift funds offshore to capture the better yield, the people said. The recent move was made under the guidance of the nation’s forex market self-disciplinary mechanism, they said.

China’s capital controls prevent individuals from moving sizable funds outside of the mainland, including to Hong Kong, companies have more leeway to do so.

The China FX Market Self-Regulatory Framework didn’t immediately reply to a Bloomberg fax seeking comment.

Chinese banks increased dollar deposit rates earlier this year to lure clients, as rising yields on the greenback boosted the appeal of dollar-denominated assets at the expense of yuan securities. Chinese firms held $453 billion of foreign currency deposits at the end of May, according to central bank data, while households had $125 billion.

The size of corporate deposits may be larger than official data shows. China’s firms have around $912 billion parked as US currency deposits in the country’s banking system, up from $758 billion at the end of 2019, according to a recent research note by Eurizon SLJ Capital Ltd.

The People’s Bank of China said last week it will adopt “comprehensive measures and stabilize expectations” about the currency. The PBOC will also “resolutely prevent risks of big fluctuations,” it said in its quarterly monetary policy report. The yuan was last down 0.3% to about 7.24 per dollar after touching a low of 7.27 last week.