US underlying inflation picked up along with consumer spending as the third quarter drew to a close, government figures showed ahead of the Federal Reserve’s penultimate policy meeting of the year.

Consumer price growth also gathered pace in Tokyo, an indicator of nationwide inflation. Bank of Japan officials also meet next week, as do Bank of England policymakers. In the UK, fresh data showed employment declined for a third month.

Meantime, Israel’s central bank reduced growth estimates for this year and 2024 as the nation’s war with Hamas restrains activity.

Here are some of the charts that appeared on Bloomberg this week on the latest developments in the global economy:

US

The Fed’s preferred measure of underlying inflation accelerated to a four-month high in September and consumer spending picked up, keeping the door open to another interest-rate hike in the months ahead. The core personal consumption expenditures price index, which strips out the volatile food and energy components, rose 0.3% while inflation-adjusted household outlays rose 0.4%.

The US economy grew at the fastest pace in nearly two years last quarter on a burst of consumer spending, which will be tested in coming months. Gross domestic product accelerated to a 4.9% annualized rate, more than double the second-quarter pace, according to the government’s preliminary estimate.

In a year when the US economy exceeded almost everybody’s expectations, the underlying federal deficit roughly doubled, spotlighting a dire fiscal trajectory likely to only worsen the partisan budget battles in Washington. It also helps explain why yields on longer-term US Treasuries are reaching highs unseen since before the global financial crisis, with the government needing to issue ever more debt to cover the shortfall of revenues relative to spending.

Asia

Consumer price growth in Tokyo unexpectedly quickened for the first time in four months in October, indicating that inflation is proving stickier than expected as the BOJ prepares to set policy next week. Tokyo’s figures serve as leading indicators of national data, which will be announced next month.

South Korea’s early exports returned to growth for the first time in more than a year in another indication of recovering external demand that will offer some reassurance to investors and policymakers monitoring the health of global commerce.

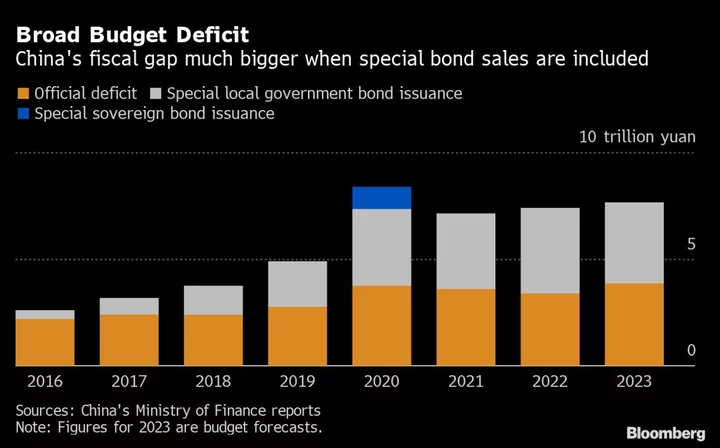

Chinese President Xi Jinping stepped up support for the world’s second-biggest economy, issuing additional sovereign debt, raising the budget deficit ratio and even making an unprecedented visit to the central bank. The budget revision underlined concerns among top leadership about the economy’s outlook into next year and the government’s increased focus on shoring up the economy and financial markets.

Europe

The UK economy lost jobs again in the three months through August, marking the longest drop in employment since the depths of the coronavirus pandemic and a sign that inflationary pressures may be abating.

Private-sector activity in the euro area kicked off the final quarter of 2023 with another dismal showing, suggesting the region’s economy may be in recession. S&P Global’s purchasing managers’ index slowed to a three-year low in October.

Emerging Markets

Mexico’s annual inflation slowed more than expected in early October as the central bank pledges to hold interest rates at a record high in Latin America’s second-largest economy.

World

Israel’s central bank revised down its economic projections as the war with Hamas becomes a big drag on growth while still leaving interest rates unchanged, as policymakers focus on propping up the shekel. The European Central Bank left interest rates unchanged for the first time in more than a year, while Canada also held. Ukraine, Hungary and Chile reduced rates, while Turkey and Russia delivered sizable hikes.

Germany’s economy is projected to dislodge Japan’s as the world’s third largest in 2023, helped by a slide in the yen against the dollar and the euro. The International Monetary Fund’s latest projections see Germany’s nominal gross domestic product at $4.43 trillion this year, compared with $4.23 trillion for Japan.

--With assistance from Christopher Anstey, Maya Averbuch, Christopher Condon, Toru Fujioka, Tom Hancock, Jennah Haque, Sam Kim, Yujing Liu, Yoshiaki Nohara, Reade Pickert, Tom Rees, Zoe Schneeweiss, Fran Wang, Alexander Weber and Erica Yokoyama.