Cathie Wood said software providers will be the next to ride on the artificial intelligence frenzy driven by Nvidia Corp.

“We are looking to the software providers who are actually right now where Nvidia was when we first bought it,” Wood, CEO and founder of Ark Investment Management LLC, told Bloomberg TV on Wednesday. While Nvidia is expected to do well over time, Ark is “onto the next thing,” she added.

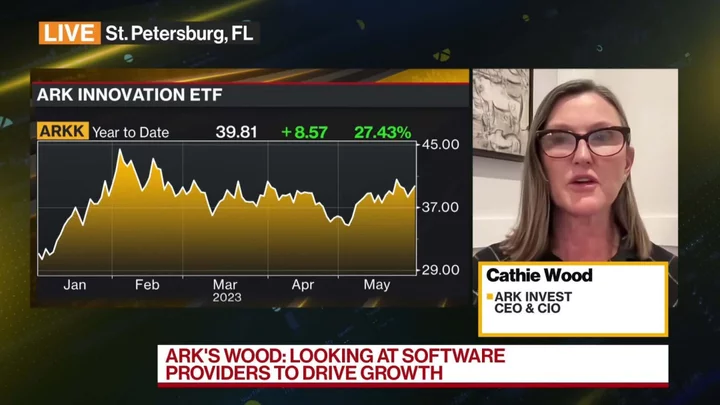

Wood’s flagship ARK Innovation ETF (ticker ARKK) cut its holding in Nvidia in January and has missed out on an epic rally that made the chipmaker briefly cross $1 trillion in market valuation. Wood has defended her decision to dump Nvidia stocks, citing concerns over the computer-chip industry’s boom-bust cycle and saying it is “priced ahead of the curve” in a tweet earlier this week.

READ: Too Rich for Cathie Wood, Nvidia Shares Stretch Valuation Limits

Instead, Wood is betting on software stocks that she expects to eventually grow in to the size of Nvidia, citing UiPath Inc. Twilio Inc. and Teladoc Health Inc. as key examples. Wood’s funds hold all three stocks.

“For every dollar of hardware that Nvidia sells, software providers, SaaS providers will generate 8 dollars in revenue,” Wood told Bloomberg TV.

Ark Innovation ETF has lost more than 10% since its peak in early February, while the Nasdaq 100 Stock Index has jumped 12% over the period.

Wood reiterated Tesla is the “biggest artificial intelligence play,” and expected its stock price to reach $2,000 in 2027 on autonomous technology from around $200 currently.

“Autonomous taxi platforms we believe globally will deliver $10 trillion in revenue from almost zero” by 2038, she said on Bloomberg TV. “Tesla many people think is an auto stock. We don’t, we think it’s much more than that.”

On China, Wood said the “common prosperity” policy agenda there means companies expanding into the country will have to give up on margins if they want that opportunity of scale.

--With assistance from Shery Ahn and Rebecca Sin.