Markets haven’t fully processed the changing interest rate environment, leading to “very strange” pricing, said Bridgewater Associates Co-Chief Investment Officer Karen Karniol-Tambour.

She pointed to the decade following the global financial crisis of 2008, when investors kept expecting rates to come back to normal — which has only recently happened. “Now we are experiencing the opposite,” with investors thinking interest rates are too high and are about to come down.

They may not fall as soon as people expect, Karniol-Tambour said, calling the current environment “a different paradigm.”

Karniol-Tambour was speaking Thursday at the Capitalize for Kids Investors Conference in Toronto. Scheduled speakers on Thursday include Balyasny Asset Management’s Dmitry Balyasny and Brevan Howard’s head of macro strategy Brian Friedman. For the full agenda, click here.

(All times New York)

Impactive’s Lauren Taylor Wolfe Is Long Concentrix

Impactive Capital founder Lauren Taylor Wolfe pitched an investment in Concentrix Corp., the second-largest outsourced customer experience company, saying near-term fears over AI growth have led shareholders to oversell.

Concentrix has diversified its end-market exposure into higher-growth areas like ecommerce, healthcare and technology, and its acquisition of Webhelp has closed a gap in geographic coverage, she said. Concentrix is down about 40% year to date.

Bornite Capital’s Dreyfus Likes Eaton Corp.

Bornite Capital Management founder Daniel Dreyfus said he likes shares of Eaton Corp., saying the power management company will benefit from AI growth and that its shares could surge 27% over the next year and 120% over the next five years.

Dreyfus said Eaton serves high-growth end markets including grid modernization, renewable energy, reshoring, electric cars and artificial intelligence. He said AI will cause data centers to consume significantly more power and that the rise of electric cars will also boost power consumption.

Dreyfus added that he thinks the company’s business will be insulated from a US consumer downturn. Its shares are up about 28% this year.

Tudor Investment Corp.’s Dabora Pitches Live Nation (11:25 a.m.)

Tudor Investment Corp. senior portfolio manager Emil Dabora pitched an investment in Live Nation Entertainment, citing explosive growth in music streaming and a boom in concert attendance.

Live Nation is under scrutiny from the US government over its allegedly anticompetitive conduct in the music industry, which has weighed on its stock price. Dabora said the company’s management thinks the probe is narrowly focused on certain Live Nation business practices and not its merger with Ticketmaster, according to the presentation.

“This is not a company that does what it wants without supervision; this is a company that is heavily monitored with legal counsel,” Dabora said. “Despite the headlines for Taylor Swift, this is not a company that has been repeatedly running afoul of what they promised to do.”

Its shares have climbed about 15% this year.

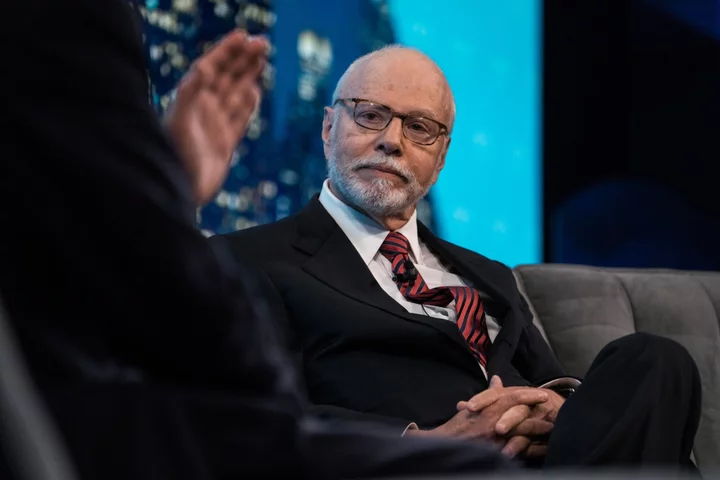

Paul Singer: Investors Are Not Scared Enough (10:30 a.m.)

Elliott Investment Management founder Paul Singer said the world is a much more dangerous place than markets are pricing in and that investors are not as worried as they should be.

What makes this period so much more precarious is that “the world is now completely dependent on the good sense of leaders to avoid an Armageddon,” he said, questioning “how much good sense” is coming from Russia, China and Iran right now.

The billionaire investor, known for his consistently bearish views, also flagged concerns about the huge investor push into private credit.

“Some of the money is being used to provide liquidity to troubled companies that are actually insolvent,” he added.

Blackstone, BlackRock Real Estate Execs Like Student Housing (10:00 a.m.)

Real estate is frequently painted with a broad brush and office is a “dirty word,” but many sub-sectors offer great opportunities, said Anne Valentine Andrews, global head of infrastructure and real estate within BlackRock Equity Private Markets.

To be clear, investors around the world are dealing with the “new world order” of higher costs, she said.

“What we’ve seen is the denominator effect, and the impact of inflation and higher rates all at once,” Andrews said. But other areas, including industrials, some retail and “everything to do with ‘living’, including student housing and childcare,” are offering “massive tailwinds,” she said.

Janice Lin, head of Canada in Blackstone’s real estate group, said student housing in particular is “a tremendous asset class” and added that data centers are a “rapidly” growing part of Blackstone’s portfolio.

Dreyfus Sees 44% Upside in RBC Bearings (9:35 a.m.)

Maria Jelescu Dreyfus of Ardinall Investment Management pitched RBC Bearings as her best idea. The company makes parts for industrial, aerospace and defense firms and has a strong growth outlook.

RBC Bearings has 44% upside the current price of about $222 a share, Dreyfus said. She expects the stock to reach $320 a share by the end of 2025 and said it may reach $1,000 a share in a decade.

The company has potential for margin expansion, opportunistic acquisitions and growth in industry volumes, she said, adding that RBC has also started working with Elon Musk’s SpaceX. By 2033, Dreyfus expects the company will see sales grow to $3 billion from $1.5 billion, and that earnings per share will jump organically by about 74%. The shares are up about 5% for the year to date.

Olin Says First Capital’s Discount is Compelling (9:15 a.m.)

Vision Capital’s Jeffrey Olin said property owner First Capital REIT trades at a compelling valuation, particularly given its portfolio of grocery stores, and is poised to benefit from Canada’s rapid population growth and low supply.

First Capital REIT is a buy because it has the highest leasing spreads and strongest internal growth among its peers, he said. FCR units, which are listed in Toronto, are trading at the widest discount to net asset value across the Canadian retail sector, he added. The shares are down about 22% this year.

“FCR typically has the best sites in the best locations in the best major urban markets,” Olin said. The company offers the potential for near-term stock gains, and the longer-run opportunity to close the gap between private and public market valuations, according to the presentation.

On Wednesday, the opening day of the conference, Axel Capital Management founder Anna Nikolayevsky pitched a long bet on semiconductor company Micron Technology Inc., while Starboard Value co-founder Jeff Smith said restaurant chain Bloomin’ Brands Inc. is undervalued and boasts strong discretionary cash flow.

Read More: C4K Latest: Axel Capital’s Anna Nikolayevsky Pitches Micron