When Dan Vahdat set out to build a healthcare startup, the UK was an ideal launchpad. That was 2011 and the nation’s deep network of medical research centers and vast National Health Service patient data sets helped him expand the software platform, Huma Therapeutics, into a $1 billion company. For the next billion dollars he is looking elsewhere.

Huma, which helps doctors monitor and analyze patient data, cuts across several sectors that the UK government vowed to prioritize after leaving the European Union three years ago. But instead of creating opportunities, Brexit and the political chaos that came with it have fostered an environment that businesses say is increasingly difficult to work with.

Vahdat’s options include moving investment to Germany or France, where President Emmanuel Macron’s team has reached out to him every few months to discuss business opportunities. The Huma founder is eyeing an eventual listing in New York, with its deeper pools of capital.

“We haven’t seen any progress” in the UK for three or four years, Vahdat said. “The hope was that with Brexit something should have changed, because the whole idea was that we were going to have more autonomy. But nothing has happened.”

Vahdat’s comments would be easy to dismiss if he was an outlier. But they follow an outpouring of complaints from leaders of some of the world’s best-known companies about the declining investment appeal of the world’s sixth-largest economy. Taken together, they paint a picture of a country adrift at a time when the $370 billion green subsidy program in the US has kicked off an economic arms race.

The FTSE 100 is up just 1.5% this year — lagging behind other indexes in the US and Europe. And investors do not appear convinced that UK Prime Minister Rishi Sunak’s plans will be enough to jumpstart growth, creating an opportunity for the opposition Labour Party leader Keir Starmer ahead of an election expected next year. His pitch to big business includes an ambition to borrow up to £28 billion a year to accelerate Britain’s green transition by building wind farms, insulating homes, delivering new nuclear capacity and developing nascent green industries.

US pharmaceutical giant Eli Lilly & Co. cited a “stifling commercial environment” that doesn’t invite investment while suspending UK expansion plans in May. Brad Smith, the president of Microsoft Corp., said the UK’s decision to block its acquisition of Activision Blizzard Inc. showed the EU was “better for business.” James Dyson, the Brexit supporting founder of the eponymous maker of high-end vacuums and fans, has recently accused the government of “scandalous neglect” of the science sector.

Covid-19 vaccine producer AstraZeneca Plc and carmaker Stellantis NV have blamed government policies for forcing them to look abroad for factory sites. In one particularly stinging blow in March, home-grown chip-designer Arm Ltd. chose New York over London for what is likely to be the biggest initial public offering of the year. And last week a group of almost 1,000 tech companies including Alphabet Inc. and Apple Inc. warned the UK is falling behind in sectors like AI and semiconductors.

The frustrations extend beyond the high tech sector.

“The government needs to show that it is listening to not just one area of business,” said Martha Lane Fox, President of the British Chambers of Commerce and a tech entrepreneur, “but the whole country, and really responding to the needs of businesses across multiple different sectors.”

‘Extraordinarily Bureaucratic’

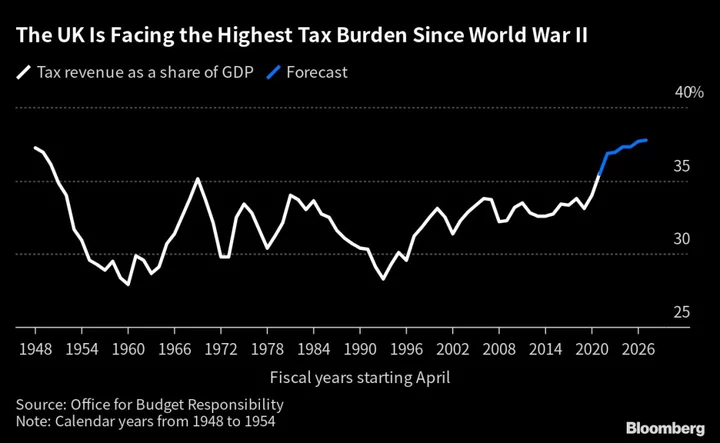

Business leaders say the government has failed to set out a strategy on a scale necessary both to overcome loss of access to the European single market and contest the economic arms race kick-started by the Inflation Reduction Act in the US last year. Complaints about the UK are centered around the high tax burden, out-of-date regulations and lack of government support. The health service needs rescuing, regulations need trimming and updating, tax incentives need focus, the executives say.

“We are an extraordinarily bureaucratic country,” Guy Hands, the chairman of private equity firm Terra Firma told Bloomberg TV in May. “The EU got blamed for bureaucracy. The reality is, we’ve left the EU and we’ve lost none of that bureaucracy. If anything, we’ve actually increased it.”

Political turmoil has not helped. Inaction and uncertainty have been hallmarks of policy since Britons voted to leave the EU, as five prime ministers cycled through Downing Street’s black door, including former Prime Minister Boris Johnson who in 2018 made the infamous proclamation “f**k business.”

Business leaders credit Sunak with restoring stability and concede that, barring access to the EU single market, the UK retains the advantages that made it Europe’s favorite investment destination: top universities and schools, English law, the English language, London and a flexible workforce. The country may lag France on new projects but has shifted to a “value over volume” strategy. On that measure it’s far ahead in terms of jobs created per project and R&D intensity, according to the EY Attractiveness Survey. Despite the economic downturn and political instability in Westminster, Britain still secured 26% of all European financial services foreign direct investment projects in 2022.

“It is really easy to see the areas that could be successful in the UK in the next 10 to 20 years,” Lloyds Banking Group Chief Executive Charlie Nunn told Bloomberg on May 30. “The transition to net zero, energy, housing and infrastructure. There is massive demand for investment in these areas, but we need a strong framework and policies to make it possible to create a market and finance these projects.”

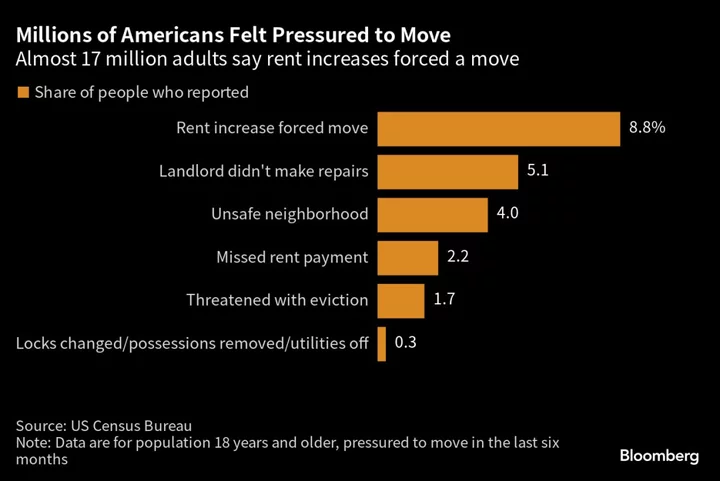

Planning is a persistent issue. It takes five years to get approval to build a wind farm according to trade body RenewableUK, and then the electricity grid may not even have capacity to take the power. Reforms to speed up house building were watered down last year, exacerbating a housing shortfall that some estimates place in the millions. In healthcare, a 41% collapse between 2017 and 2021 in the number of clinical trials initiated in the UK threatens innovation in the life sciences industry.

The broader regulatory backdrop is no better. Business leaders say the pendulum has swung so far to consumer protection that it’s suffocating growth. The government has been battling financial regulators to relax banking rules to increase risk-taking. Tech lobbyists warn that, while giants like Microsoft will inevitably have their wings clipped, blocking tie-ups among smaller players like the tech investment companies Seedrs Ltd and Crowdcube Ltd will only encourage founders to leave the UK.

Read more: The Labour Party Is Winning the Business Vote

Chancellor Jeremy Hunt’s budget in March was another disappointment to many business leaders. Corporation tax was raised from 19% to 25% accompanied by a generous three-year 100% relief on capital spending that was supposed to help close the investment gap with Germany and France. But the government’s own forecasting body has said that the incentive’s time limit means it will do nothing for long-term growth.

“I don’t care whether it’s a growth strategy or competitiveness, there’s got to be a profound point of view as to how Britain is going to compete,” said Archie Norman, chairman of retailer Marks & Spencer and a former Tory MP. “A competitive economy is one where the public and private sector work together on regulation, on trade, on investment in skills, on how government supports entrepreneurs, how we shape the tax system. At the moment that’s come slightly adrift post-Brexit.”

The government’s apparent lack of ambition can be seen in its response to the US green plan, which it initially dismissed as dangerous. “That’s a seismic act of competitive strategy. And we can’t say, ‘oh, we don't do that’. You can’t sit out of it,” Norman added.

Announcements this year, including a £1 billion ($1.2 billion) pledge for semiconductor research, a possible £500 million loan guarantee for carmaker Jaguar Land Rover to build a giga factory and a package of rehashed green energy plans were dwarfed by the tens of billions of dollars being promised by the US and Europe.

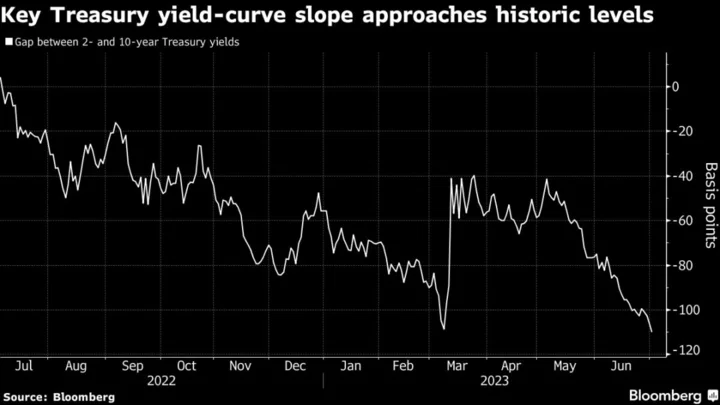

The UK also starts the new global race with a handicap. The British economy has been the slowest to recover from Covid of all Group of Seven nations and is the only one with a smaller workforce than before the pandemic. The tax burden is the biggest since the Second World War, yet public services remain desperately underfunded, and inflation at 8.7% is among the highest in the developed world. That persistent inflation means UK government bonds are among the worst-performing across major developed economies this year. The yield on 10-year securities has climbed more than 120 basis points from a low in February to over 4.20% last week — levels seen during last year's gilt crisis.

“The US has changed the rules of engagement,” said Raoul Ruparel, a former special adviser to ex-Prime Minister Theresa May who’s now director of Boston Consulting Group’s Centre for Growth. “It doesn’t feel like we are leveling the kind of response needed.”

‘Wake Up’

The backlash from business leaders is a measure of how far the Conservative Party’s reputation has fallen. Between 2010 and 2016, the UK was Europe’s undisputed capital for FDI, with David Cameron’s government providing Home Office hotlines to ensure visa applications were fast-tracked, rolling out the Royal family to burnish egos, and cutting corporation and entrepreneur taxes.

In France, Macron took the lessons to heart, establishing a generous tax regime for talented foreign workers and holding lavish gatherings for bosses in the Palace of Versailles. By 2019, the cost of the damage to the UK was clear. France overtook Britain in new FDI projects for the first time in 20 years, according to the EY survey. FDI to the UK as a share of gross domestic product plunged to 0.5% in 2022, down from 1.3% in 2015, according to the OECD. It also slipped in France, from 1.9% in 2015 to 1.5% in 2022, but remains strong.

For the Labour Party, which has a double-digit lead in public opinion polls and secured big gains at Sunak’s expense during local elections in May, the criticisms are a gift. Starmer has been winning over business support in a campaign similar to former Prime Minister Tony Blair’s “prawn cocktail offensive” before his election win in 1997.

“Wake up,” Starmer chided Sunak in the House of Commons last month, accusing him of being content with “managed decline.” “It’s not the 1980s any more. A race is on. We need to be in it.”

Rachel Reeves, Starmer’s pick for chancellor of the exchequer if Labour wins the next election, has promised a more interventionist approach from government, targeting growth in key industries such as life sciences. She’s also pledged to set up a business tax roadmap to give companies clarity beyond the lifetime of a single parliament.

In an effort to counter the narrative, Sunak hosted scores of UK-based business leaders at an event in April in which he paced across the stage like a Silicon Valley executive. “This government is unashamedly pro-business,” the prime minister said, arguing the UK was “pretty much the most attractive place to invest anywhere in the world.”

Things quickly went wrong. Gerry Murphy, the chairman of Britain’s biggest luxury fashion firm Burberry Group Plc, questioned Sunak’s “perverse” decision as chancellor to scrap VAT-free shopping for tourists, making the UK the “least attractive shopping destination in Europe.”

It may not have been the most auspicious start but at least Sunak was trying to repair relations. Howard Davies, chair of NatWest, expressed some sympathy for Sunak and Hunt. “Their inheritance was very unattractive,” he said. Even Burberry’s Murphy said that the current government is “obviously more business friendly than some previous administrations.”

Sunak is also championing the digital, life sciences and green industries to create “the Silicon Valleys of the 21st century” but has committed precious little money. He’s hoping to release private capital for growth investment through a series of pension reforms but Richard Buxton, veteran fund manager at Jupiter Asset Management, fears the government lacks the courage to make the legislative changes needed.

Vahdat, the healthcare software entrepreneur, says that under previous UK governments he was in regular contact with civil servants and ministers, including being invited to attend a trade delegation to China in 2018. Now, he says, whenever he approaches contacts in government and other departments, he gets the impression they are too busy to process his queries and suggestions.

“France has been very, very persuasive with tax benefits, really trying to open doors and opportunities. Same goes in the US as well,” he said. “In the UK, no one offers anything. If anything, they’re taking things away.”

--With assistance from Andrew Atkinson, Stephanie Davidson and Simon Kennedy.

Author: Philip Aldrick, Lucy White, William Shaw, Katherine Griffiths and Caroline Hepker