By Gabriel Burin and Noe Torres

BUENOS AIRES/MEXICO CITY Brazilian stocks are expected to keep drifting higher this year on mixed company earnings, as food exporters feel the pinch from slower global growth, while banks take advantage of sky-high interest rates, a Reuters poll showed.

The Bovespa equity index has been climbing back in recent weeks towards the 110,000 points mark that is close to its mid-level since the COVID pandemic began to subside in late 2021. The gradual uptrend is set to continue in coming months.

Domestic stocks are seen gaining 8.9% to 120,000 points from Monday's 110,213.12 close, according to the median estimate of 12 market strategists polled May 10-18. This would imply a total 9.4% increase in 2023.

"Quarterly results are far from ideal ... Even sectors that are more protected, such as commodities, are suffering from the global slowdown, which derives in lower demand for Brazilian assets," Alexandre Jung, director at Acqua Vero, said.

This month, Brazil's JBS SA, the world's largest meat company, as well as poultry and pork processor BRF SA posted worse-than-expected results, citing high grain costs and oversupply in their markets.

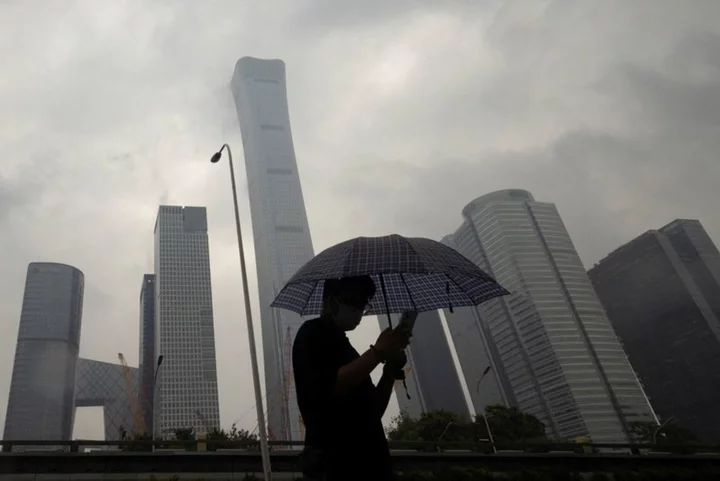

At the same time, steep prices for animal feed crops such as soybeans - one of Brazil's top exports - are no longer enough to boost balance sheets at agribusiness companies face weaker Chinese demand.

But, on the other hand, Brazilian lenders such as Banco do Brasil SA and Itau Unibanco Holding SA remain very lucrative, thanks to larger loan portfolios and better rate spreads from the central bank's hawkish stance.

Brazil's lofty benchmark rate, currently at 13.75%, is helping financial firms reap chunky margins. This is dampening the economy, though, and creating tensions between the central bank and government officials who want faster growth.

Still, an agreement between both camps should lead to policy easing at some point, which is likely to propel Brazilian stocks higher. In the poll, the consensus estimate for the Bovespa index at the end of next year stood at 131,500 points.

In Mexico, whose economy is enjoying a good period that contrasts with trouble in other parts of Latin America, the S&P/BMV IPC stock index is expected to rise 7.5% to 57,475 points by year-end, for a total gain of 18.6% in 2023.

(Other stories from the Reuters Q1 global stock markets poll package:)

(Reporting and polling by Gabriel Burin in Buenos Aires; Additional polling by Noe Torres in Mexico City; Editing by Alison Williams)