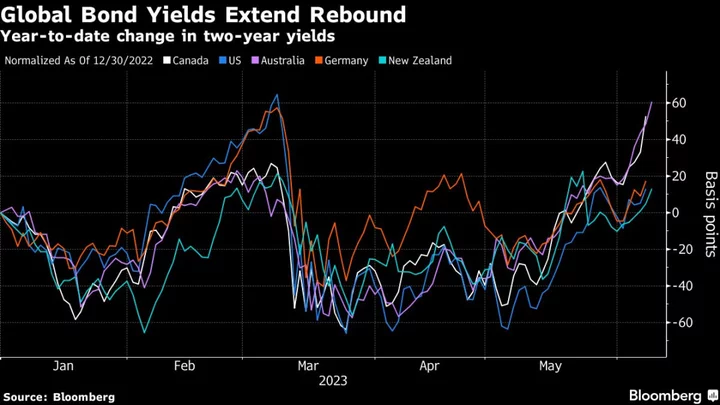

Bonds are slumping from the US to Australia as early hawkish signs from this month’s slew of central-bank meetings spurred traders to renew bets on an extended interest-rate hiking cycle.

Shorter-maturity Treasury yields are close to their highest since March, while their Australian equivalents have jumped to levels last seen more than a decade ago. Investors are back ditching sovereign debt after the Bank of Canada joined the Reserve Bank of Australia this week in surprising markets with another rate hike to combat stubbornly fast consumer-price gains.

The tightening is convincing traders to rethink their bets of US rate cuts later this year, underscoring risks that the battle against inflation may be far from over.

“The Reserve Bank of Australia defied economist predictions to increase the cash rate again this week, which may put more pressure on the European Central Bank, US Federal Reserve, Bank of Japan and Bank of England,” said Colin Graham, head of multi-asset strategies at Robeco. “Expectations for July have now shifted from an expected cut to an expected rise” for the Fed, he said.

Global Yields Climb as Traders Lean Toward Fed Hike by July

Treasury yields were little changed in Asia Thursday, with the 10-year just below 3.8%, up about 10 basis points this week. Australia’s three-year yield jumped as much as 14 basis points to 3.84%, the highest since 2012.

Investors briefly priced in a full quarter-point rate hike by the Fed by July, though they still expect some easing by year-end. All eyes will be on US inflation data next week, which will provide further clues on the Fed’s policy path.

“With inflation having proved more stubborn than we’d thought, we now think the central bank will keep its policy rate higher for longer than we had previously projected,” Diana Iovanel, economist at Capital Economics, wrote in a note.