Treasury 10-year and 30-year yields reached new multiyear highs Monday as a selloff in bonds resumed in the kickoff to trading in the final quarter of the year.

Yields across the Treasury curve rose by more than 10 basis points on the day for notes and bonds maturing in five to 30 years. The benchmark 10-year note’s nearly touched 4.70%, the highest level since 2007, while the 30-year bond’s exceeded 4.81%, the highest since 2010.

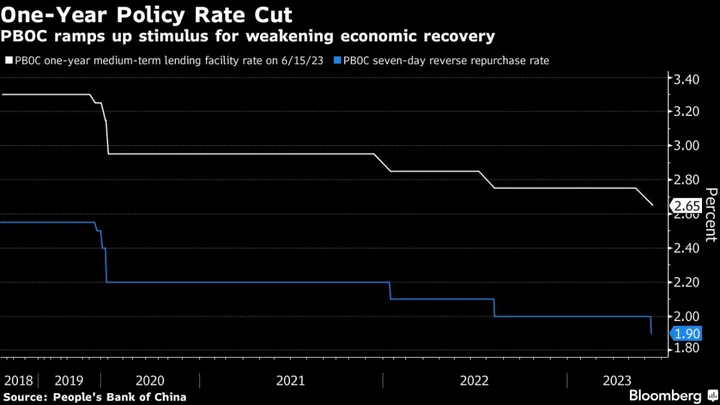

Bonds fell on the first day of trading after lawmakers avoided a government shutdown, agreeing to fund federal operations through Nov. 17. That prompted traders to price in higher odds the Federal Reserve will hike interest rates this year, and to further pare bets on rate cuts next year. Monday’s main economic release, the ISM manufacturing report for September, rose more than anticipated, however, its prices-paid component unexpectedly declined.

“The strength of the consumer, the strength of the housing market, and even the resilience of manufacturing given the run-up in rates that we’ve had, tells us that the economy is quite a bit stronger fundamentally than it was in the previous cycle,” Sonia Meskin, head of US macro at BNY Mellon Investment Management, said on Bloomberg Television.

Also Monday, Fed Governor Michelle Bowman reiterated her view that multiple interest-rate hikes may be required to get inflation down to the central bank’s goal.

The prospect of a US government shutdown beginning Oct. 1 threatened to handicap Fed policy makers who meet to decide whether to raise interest rates again on Nov. 1 and Dec. 13 by delaying publication of critical economic data. Fed swap rates assign nearly 60% odds to another quarter-point rate increase, up from under 50% last week.

--With assistance from Carter Johnson.