For investors stashing record sums in cash, US bond managers overseeing a combined $2.5 trillion have a bit of advice: It’s time to put that money to work.

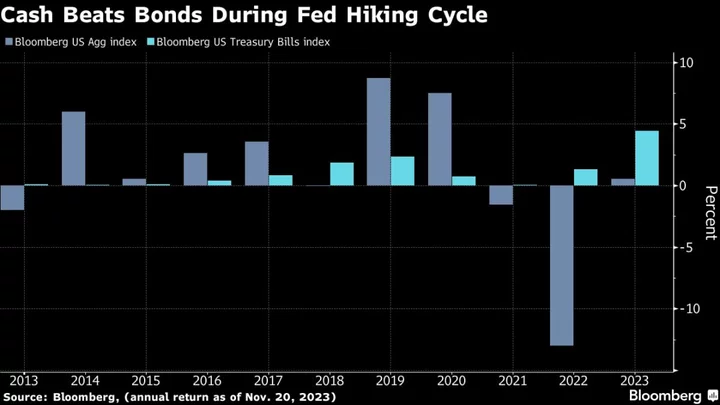

That’s the message from Capital Group, DoubleLine Capital, Pimco and TCW Group. And it comes as many fixed-income managers are still licking their wounds following a tough year that’s seen the bond market trail ultrasafe T-bills and money-funds carrying the highest rates in decades.

For these West Coast bond managers, this month shows the risk of staying in cash too long. Signs of ebbing inflation and softer growth have fueled a 3.4% surge in the Bloomberg US Aggregate Index in November, bringing it back to about flat for 2023 as of Nov. 17. That’s still well short of what cash has earned this year. But it shows what a real turning point could deliver after a year marked by head fakes over price pressures and Federal Reserve policy.

The asset managers said in interviews last week that they’re comfortable buying Treasuries and other high-quality bonds at levels they finally see as attractive. And they generally agreed on extending interest-rate risk as far as the five-year area of Treasuries, while also owning mortgage debt, which they consider cheap.

“My sense of things right now is that 4 1/2 to 5% is a safe place to be buying bonds,” said Greg Whiteley, head of government securities investing at DoubleLine.

He likes Treasuries due in around five years because he says the segment has scope to gain as traders price in more Fed cuts. The area is also less vulnerable than longer maturities given worries about US deficits and borrowing needs, as well as sticky inflation.

Treasuries are on pace to halt a six-month slide. Ten-year yields tumbled below 4.4% at one point last week after touching 5% in October for the first time since 2007. The rally means US government bonds have a chance to avoid an unprecedented third straight year of losses.

Naturally, active managers are doing their best to persuade investors holding a record $5.7 trillion in money-market funds to funnel cash their way and into longer-dated bonds, which stand to benefit should the economy weaken.

Read more: Bond Managers Wary of False Dawns See Signs This Time’s for Real

The potential for that scenario has started to look stronger for the four money managers. Strains among consumers in areas such as auto loans and pressure across commercial real estate suggest to them that 2024 will see a material economic slowdown and lead to Fed easing.

While the appeal of cash is clear, “at some point, though, and you’ve seen this just over the course of this month, that approach means you miss all the potential price appreciation if the economy starts to slow,” said Ryan Murphy, head of fixed-income business development at Capital Group.

The firm’s $76 billion Bond Fund of America fund has gained 3.4% in the past month, leaving it down about 0.1% this year through Nov. 17, data compiled by Bloomberg show.

An inverted curve with bill rates above 5% poses a hurdle in convincing investors to take more risk in bonds, especially with the Fed signaling it’s in no rush to lower rates.

For investors, it’s hard to abandon cash and “tread back into shark-infested water,” said Dan Ivascyn, chief investment officer at Pacific Investment Management Co.

In the past month, the $126 billion Pimco Income Fund that he co-manages has gained 3%, for a year-to-date return of 5%, data compiled by Bloomberg show.

With inflation still elevated, the market may have been leaning too far in favor of Fed cuts, he said last week. However, he still expects easing next year.

“Next year’s theme may be a reminder that your cash rate’s only guaranteed overnight,” he said. “And if and when the Fed starts cutting rates you may wish you locked some of those rates in.”

‘Compelling’ Mortgages

Several firms — DoubleLine, Pimco and TCW — pointed to mortgage debt as a beaten-down area they expect to boost performance in 2024.

Spreads on Fannie Mae current coupon bonds, a proxy for mortgage securities being created now, are wider than the 10-year average, and the outlook has brightened in part because of bets on Fed easing.

Read more: MBS Look Cheap to Fund Managers From Saba to Janus as Fed Pauses

Owning mortgages is a “compelling trade” for the next year, said Peter Van Gelderen, co-head of the securitized group at TCW.

DoubleLine’s Whitely said the firm is overweight mortgages, and Ivascyn said the same for the Pimco Income Fund.

“Uncertainty related to interest rates and uncertainty related to regulation for banks” has hurt the market this year, and that tide will turn with mortgage spreads at “a historically cheap level,” Van Gelderen said.

--With assistance from Tania Chen and Scott Carpenter.