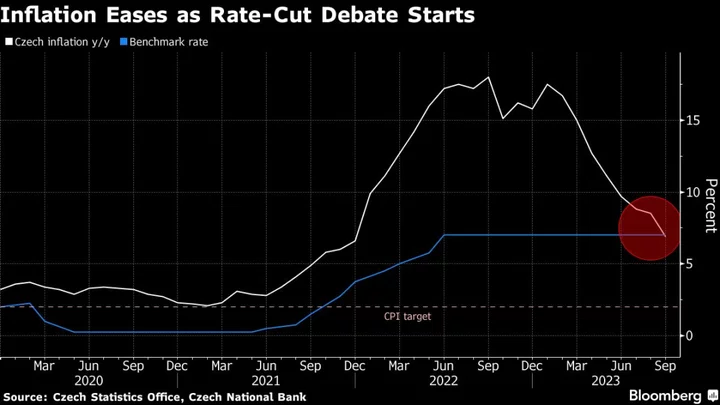

Bank of England policy maker Swati Dhingra suggested patience in returning inflation to target, saying it will take time for the full force of the central bank’s interest rate hikes to have an impact on the economy.

The official who sits on the BOE’s nine-member Monetary Policy Committee said fixed-rate mortgages and other issues have slowed down the process of transmitting rate hikes to consumers and businesses — but that those increases will bite in time.

“The lags in monetary policy transmission imply that there is little we can do to affect inflation in the immediate future, and we will always need to monitor the progress of the economy closely to calibrate the monetary policy stance over the medium term,” Dhingra said in the text of a speech released Tuesday by the BOE.

The remarks help explain why Dhingra voted in the minority last month to keep borrowing costs unchanged while much of the rest of the panel opted to continue the quickest tightening in four decades.

While Dhingra agreed that inflation is too high and needs to return to the 2% target, she said a number of factors are slowing down the impact of policy and complicating decision making.

A higher proportion of fixed-term mortgages mean it takes longer for interest hikes to be felt by consumers, Dhingra said.

Read more: UK Households Face Monthly Mortgage Payment Shock

Globalization and the growth of the services sector in the UK also mean we have an “imprecise” understanding of how inflation now works, she added.

Historically, Dhingra noted, consumer prices closely tracked producer prices — except when a large shock drove up producer prices, which typically resulted in a longer lag before consumer prices followed them back down.

Noting the recent sharp drop in producer price inflation, Dhingra said the “key question” is whether this would “manifest in reduced consumer price inflation as it did in previous inflationary episodes, albeit with a lag.”

There was little evidence so far that UK supermarkets were driving food prices higher through “greedflation”, or rebuilding their profit margins, she added.

Read more: UK Greedflation Concerns are Groundless, Ex-BOE Rate Setter Says

“A more likely explanation for food price inflation is the lagged transmission of the big international supply shocks,” Dhingra said.

Given the changes which the UK economy has experienced over the last several decades and will continue to face, including a susceptibility to international shocks and climate change, she said policy makers “need to pro-actively develop the data and analytic infrastructure to address the past, current and forthcoming challenges.”

Read more:

- Bailey Says BOE Must Sharpen Response to Big Economic Shocks

- Bailey Laments Slow Falling Inflation In ‘Very Tight’ Job Market

- UK Latest: Labor Market Tightens as Wages Surge (Video)

(Adds more comment from Dhingra’s speech)