BlackRock’s Investment Institute downgraded Chinese stocks to neutral from overweight, citing concerns over the nation’s property sector and the limited boost from stimulus.

“Growth has slowed. Policy stimulus is not as large as in the past,” strategists including Jean Boivin wrote in a report Monday. “Structural challenges imply deteriorating long-term growth. Geopolitical risks persist.”

Just a week ago, the think tank at the world’s biggest asset manager expressed hopes for China’s stimulus measures, saying subdued inflation would create space for more policy easing, while also citing low valuations. BII last upgraded Chinese stocks in February to overweight, citing short-term opportunities from the reopening. Since then, the MSCI China Index has lost 13%.

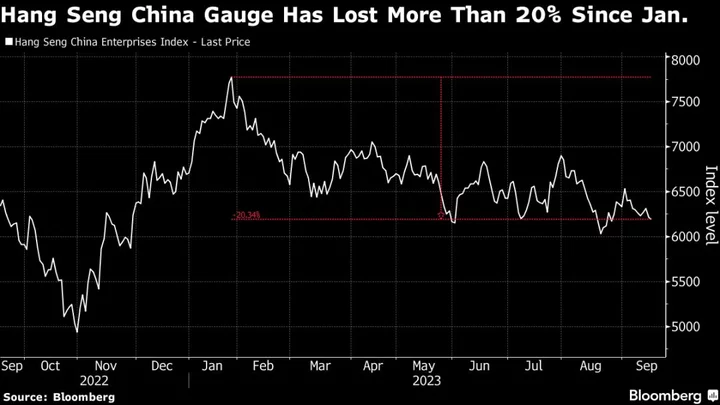

Chinese stocks are among the world’s worst performers this year, with the Hang Seng China Enterprises Index having fallen more than 20% from a January high. The country’s economy is struggling with default risks in the property market and a sluggish recovery in domestic consumption. Beijing has announced various stimulus measures since July, with limited effect.

The MSCI China Index was down 0.2% as of 10:47 a.m. in Hong Kong, heading for its lowest close in almost a month.

Given the drag of a slowing Chinese economy, BlackRock strategists cut emerging-market stocks to neutral from overweight as well. “We see growth on a weaker trajectory and see only limited policy stimulus from China,” it said.

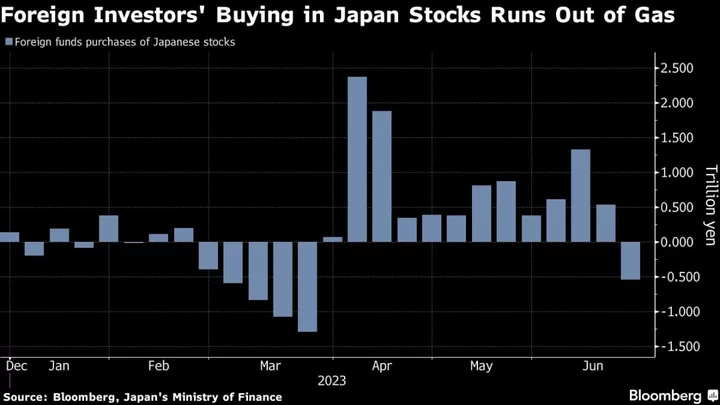

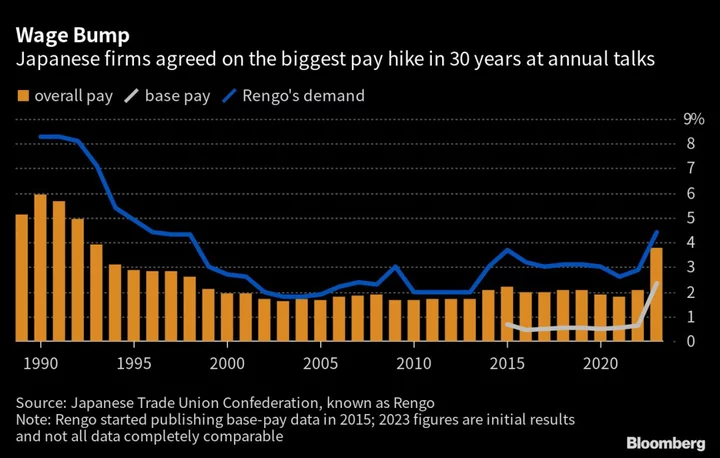

In the meantime, BlackRock strategists further upgraded Japanese stocks, thanks to “strong earnings, share buybacks and other shareholder-friendly corporate reforms.”