Ask anyone to name a typical characteristic exhibited by Bitcoin and they might mention that it’s volatile. But it turns out that of late, the most popular digital token has been anything but.

Gauges that measure the price swings of the original cryptocurrency, which is trading at around $29,000, have been trending down — 90-day volatility is at its lowest since 2016, according to data compiled by Bloomberg.

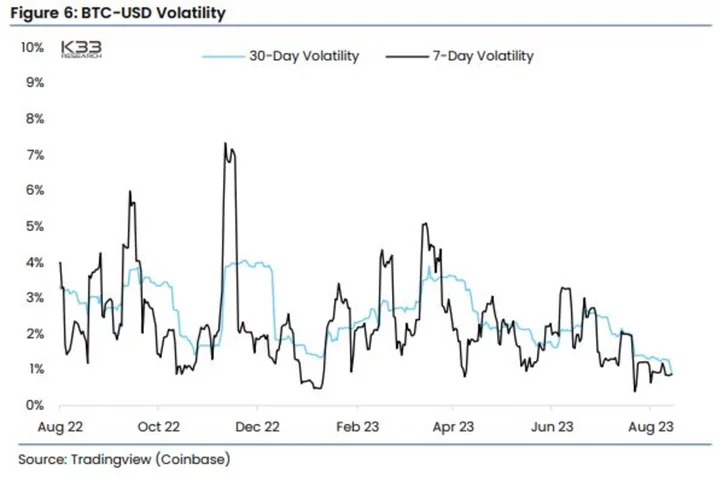

Meanwhile, three-month implied volatility sits at 35, according to researcher K33. For comparison, consider what happened in October 2020: it hit a then-all-time-low of 56, after having gone 47 days without a 5% move.

“The deafening silence from the market throughout the summer of 2023 has pushed implied volatilities well below former all-time lows,” wrote the firm’s Bendik Schei and Vetle Lunde.

It’s an unusual stretch of calm for the token, which has over the years garnered attention for its wild price swings. In the past, it’s not been abnormal for it to see 5% or 10% swings one day that are then reversed the next session.

That’s why its recent lassitude hasn’t gone unnoticed, and any number of other volatility measures show similar listlessness.

Bitcoin has been “trading within a historically low-volatility regime, with several metrics indicating extreme apathy and exhaustion,” according to analysts at Glassnode. For one, they refer to what’s known as upper and lower Bollinger Bands, which are right now separated by just 2.9%. A tighter spread’s only been seen on two prior occasions.

While the price action was a bit more exciting in June — when BlackRock Inc. shocked markets after filing for a spot-Bitcoin ETF — things have calmed down since. Bitcoin has hovered around $29,000 every trading session in August so far, data compiled by Bloomberg shows.

Secular narratives around Bitcoin, such as it disrupting traditional finance, can be thought of as being longer-term drivers, says Kara Murphy, CIO at Kestra Investment Management. “But then in the near-term, there are periods during which Bitcoin is a very high-risk call option on free money,” she said.

“What we’ve seen is that now that the Fed rate-tightening cycle is over, that long-term secular story is becoming more important and Bitcoin’s become a little bit more boring, because that secular story doesn’t necessarily change from day to day.”