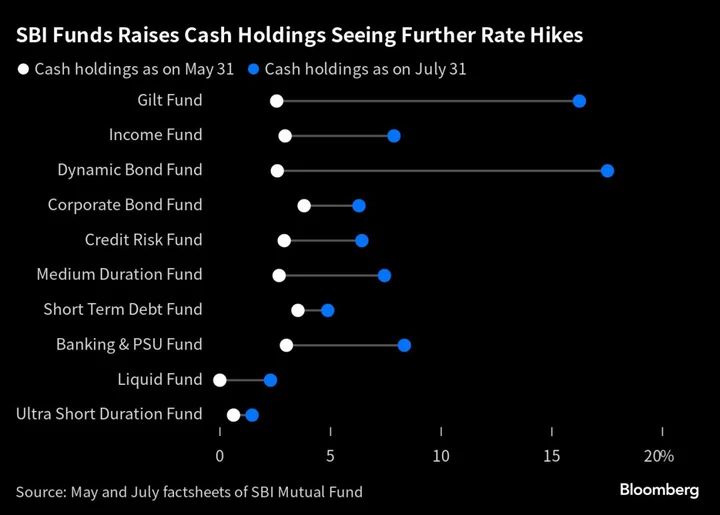

India’s biggest asset manager is bolstering its cash holdings on bets the central bank will raise borrowing costs further, helping it deploy funds at higher yields.

SBI Funds Management Pvt. has been trimming the duration of its portfolio since May and wants to keep the cash handy for better investment opportunities as a sudden spike in inflation sparks debate on odds of more rate hikes. Yields on India’s benchmark 10-year bond are on a rise, advancing 27 basis points from their May low.

“Growth estimates getting better and signs that there could be a dislocation for prices has forced us to reassess,” Rajeev Radhakrishnan, chief investment officer for fixed income at SBI Funds, said in an interview. “The idea is to reduce duration and that has converted into cash.”

The assessment makes it one of the very few money mangers to call for a rate increase, with most market players just pushing back the rate-cut bets to later next year after a surge in food prices sent July inflation to a 15-month high.

The Reserve Bank of India this month left its key interest rate unchanged for a third straight meeting and asked banks to set aside more cash to mop up excess liquidity, signaling heightened vigilance against soaring prices. The acceleration in July prices made economists raise their inflation forecasts, while the yields last week climbed to the highest since April.

Radhakrishnan wants to hold on to cash in the near term as it gives him the flexibility to react and returns are comparable with short-term investments after RBI’s liquidity-squeezing measures hardened money market rates. The overnight call money rate is at 6.84% on Tuesday, three basis points higher than the three-month treasury bill.

The cash component of SBI’s Dynamic Bond Fund, which invests across durations, saw one of the biggest increases among the various debt plans offered by the asset manager. The holdings rose to 17.5% of its assets under management at end-July, compared with 2.6% two months ago. The average maturity of the fund has more than halved to four years in the period.

“My base case is the RBI will need to keep financial conditions tighter and probably raise rates further,” Radhakrishnan said. “There is no reason for the authority to lose track of the 4% inflation target.”

(Updates numbers throughout the story.)