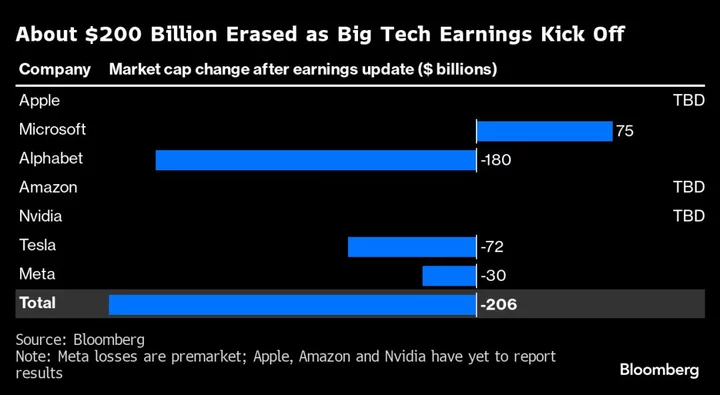

The so-called Magnificent Seven technology companies that have powered this year’s US stock rally are posting disappointing earnings, wiping $200 billion off their market value and threatening to push the S&P 500 into a correction.

Google owner Alphabet Inc., Tesla Inc. and Facebook parent Meta Platforms Inc. have all slumped since reporting, with Microsoft Corp. the only bright spot. Amazon.com Inc. publishes results after the close Thursday, and the options market is implying a one-day move for the stock of 8.1% in either direction — putting about $100 billion in market value in play.

The remaining two — Apple Inc. and Nvidia Corp. — are due to report next month.

The seven companies have been the story of the year in the stock market, with a frenzy of interest around artificial intelligence fueling gains for many of them. The optimism is waning because of higher interest rates and war in the Middle East — the S&P 500 has fallen 8.8% from its 2023 peak, putting it within reach of the 10% drop that’s defined as a correction in a bull market.

Yet there’s still plenty of euphoria left. The tech-heavy Nasdaq 100 Index, dominated by the Magnificent Seven, remains up 31% for year, meaning there’s plenty of room for the market to fall.

Read more: Alphabet 10% Plunge Follows Tesla in Stern Warning on Valuation

Meta’s results are going to weigh on the market when trading opens Thursday. The stock fell 2.4% in premarket trading after the social media giant dashed investors’ hopes for a long-term advertising recovery, saying it was at the whim of an uncertain economic environment.

This comes on the heels of Alphabet erasing almost $180 billion in market value on Wednesday after the company’s cloud unit reported a smaller-than-expected profit. The loss was the biggest single-session market value wipeout for the search giant. Earlier in the month, Tesla’s value shrank by $72 billion in one day after its results.

For now, the only glimmer of hope among the big seven is Microsoft. The Windows software maker rallied to add about $75 billion in market value on Wednesday, after the software giant reported first-quarter results that beat expectations.

Alphabet and Microsoft, which both trail Amazon in cloud infrastructure, have been racing to build up their AI offerings as a way to make their platforms more enticing to customers. Their diverging sets of results raise the bar for cloud computing leader Amazon when it reports earnings on Thursday.

--With assistance from Tom Contiliano.