By Huw Jones

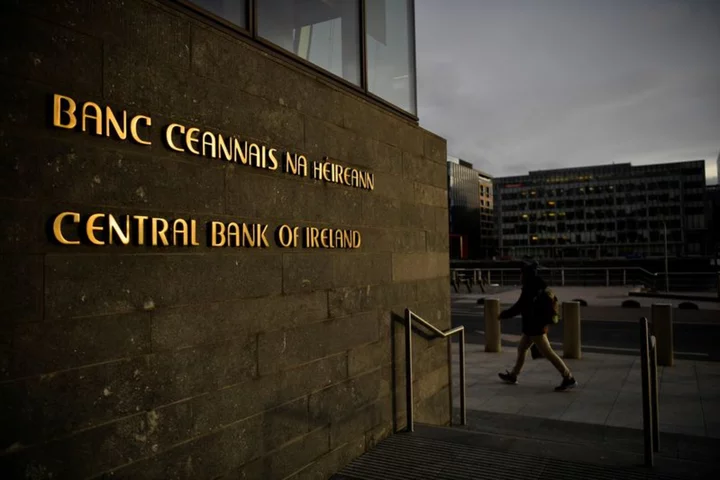

LONDON European Union banks already largely meet tougher global capital rules to bolster defences against economic crises and now only need to find another 600 million euros ($635.8 million) ahead of a 2028 deadline, the bloc's banking watchdog said on Tuesday.

The global Basel Committee agreed additional capital rules in 2017 that require banks to hold bigger reserves to shield them from potential shocks. These marked the last leg of the Basel Committee's revamp of core mandatory capital buffers after banks were bailed out during the 2008 global financial crisis.

The EU, along with Britain and the United States, is now putting the final Basel requirements into its rule books.

The European Banking Authority (EBA) on Tuesday published the results of its monitoring exercise of 157 banks across the EU at the end of 2022, which looked at how they were implementing Basel rules.

"The main finding is that to comply with the new framework, EU banks would need a total of 0.6 billion euro of additional Tier 1 capital at the full implementation data in 2028," EBA said.

"Overall, the results of the mandatory Basel III capital monitoring exercise show that European banks' minimum Tier 1 capital requirement would increase by 9.0% at the full implementation date in 2028."

Basel has a 2028 deadline for implementing its remaining rules, which are set to be rolled out in the EU from January 2025. But EU policymakers have proposed longer phase-ins for some of them, and temporary waivers for others, which would cut the core capital shortfall to an estimated 240 million euros, EBA said.

The United States has proposed beginning its "Basel Endgame" six months later and completing it in 2028, though regulators are facing a heavy backlash from banks which say capital burdens will rise significantly.

Banks in Britain are also lobbying for the Bank of England to align its rollout start date with the United States, and to soften some of the rules in line with steps being taken by the EU. The BoE is due to set out its final Basel Endgame rules sometime in 2024.

Separately on Tuesday, the Basel Committee said global shortfalls among banks for meeting full implementation of its core capital rules was around 3 billion euros at the end of December 2022, down from about 7.8 billion euros six months earlier.

The aggregate shortfalls globally and in the EU represent a fraction of banks' total capital buffers and earnings.

($1 = 0.9437 euros)

(Reporting by Huw Jones; Editing by Jacqueline Wong and Jane Merriman)