Israel’s central bank laid out its most detailed assessment yet of the economic implications of the war with Hamas, as it holds off on interest-rate cuts in favor of stabilizing markets.

An updated outlook from the bank’s research department put the conflict’s “gross effect” on Israel at 198 billion shekels ($53 billion), with defense expenditure comprising more than half of the total. The war’s fiscal price tag was previously estimated at 180 billion shekels in 2023-2024 by Leader Capital Markets, with the Finance Ministry saying it’s costing the economy close to $270 million every day.

The Bank of Israel’s in-house research team also lowered its economic growth projections and now expects gross domestic product to expand 2% this year and next — compared with previous estimates for 2.3% in 2023 and 2.8% in 2024. The Finance Ministry has the same GDP forecast for this year but sees slightly weaker gains ahead.

Alongside the new forecasts on Monday, the monetary committee left its key rate at 4.75%, in line with all forecasts. The shekel traded stronger against the dollar after the announcement.

Speaking after the decision, Governor Amir Yaron warned “the fiscal ramifications” of the war will endure over the medium term and urged caution from the government as it hammers out a new budget.

“Alongside the need to provide a budgetary response to needs created by the war, in emergency times as well there is considerable importance to maintaining a responsible fiscal framework,” he said. “It is important that the government cut new expenditures of a prolonged nature.”

A debate is unfolding in Israel over changes to its current budget, with central bank officials recently criticizing the ruling government’s reluctance to scrap outlays on religious programs and West Bank settlements at a time when it’s under pressure to raise funding to finance the war effort.

Israel’s worst armed conflict in half a century has ripped through the economy by paralyzing many businesses, jolting consumer demand and draining the labor market of workers following an Oct. 7 Hamas attack from Gaza that killed 1,200 people.

The cabinet is scheduled to meet later on Monday to discuss a revised fiscal plan for 2023 that’s set to boost expenditure by 30 billion shekels, much of which will be funded by debt.

Tensions over the special allocations have meanwhile ratcheted up between Prime Minister Benjamin Netanyahu and his political rival, ex-Defense Minister Benny Gantz, who recently formed a national unity government for the duration of the war. Gantz has said that his party would have to “consider its future steps” if the discretionary financing remains in the new budget.

The disagreement could become an obstacle for rate cuts at the start of next year, according to Mizrahi Tefahot Bank’s chief markets economist Ronen Menahem. It signals an unwillingness on the part of the government to change its political priorities in favor of greater fiscal discipline and focus on policies that enhance growth, he said.

In a statement accompanying the central bank’s decision on Monday, policymakers repeated almost word-for-word their guidance from last month, saying the focus is on “stabilizing the markets and reducing uncertainty, alongside price stability and supporting economic activity.”

“Insofar as the recent stability in the financial markets becomes entrenched and the inflation environment continues to moderate toward the target range, monetary policy will be able to focus more on supporting economic activity,” the central bank said.

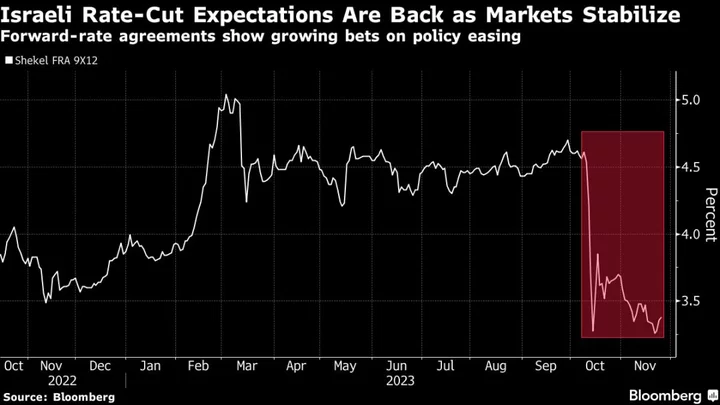

Sentiment has reversed sharply since the Bank of Israel’s monetary committee last met a month ago, when the shekel was enduring its longest run of losses in almost four decades. The course of the war remains hard to predict, however, with a short truce between Israel and Hamas set to end a day after the rate meeting.

Netanyahu’s office said negotiations were continuing on Monday afternoon over list of people to be freed next. Speaking to US President Joe Biden on Sunday, Netanyahu said every extra day of the truce is conditional on Hamas freeing 10 more hostages. Hamas said it wants a longer pause, but didn’t specify if it would release more captives.

Israel has made clear it wants to continue the war until Hamas, designated a terrorist group by the US and European Union, is destroyed. The Israeli military’s airstrikes and ground offensive on Gaza have killed around 15,000 people, according to the Hamas-run health ministry there.

As the economic damage spreads, the possibility of a rate cut is back now that the shekel appreciated nearly 9% against the dollar since the Bank of Israel’s last meeting on Oct. 23, the world’s best performance in that period.

The decision this week was the first since Yaron’s reappointment as governor for another five-year term. During his stint so far, Yaron has only cut rates once — at the height of the Covid-19 pandemic in 2020 — and has since presided over a record-long cycle of monetary tightening that took borrowing costs to their highest in 17 years.

After the war began, Yaron deployed emergency measures to stabilize markets. The shekel’s recent rebound was in large part down to the central bank’s unprecedented interventions that totaled $8.2 billion in October.

Risks around inflation may for now prove an obstacle to cutting rates in the future. Price growth has been above the government’s goal of 1% to 3% since late 2021.

The central bank on Monday said that “in view of the recent volatility of the exchange rate, depreciation of the shekel continues to pose a risk to the convergence of inflation to the target range.”

The outlook is still in flux, though Israel has so far defied some earlier predictions of a price surge, with annual inflation slowing slightly to 3.7% in October.

“This may be an inflection point for inflation, because on the long run, transport difficulties, shortage of raw materials and pressure on the housing market can push prices up,” said Ori Greenfeld, chief strategist at Psagot Investment House. “The central bank may choose to wait until there is more certainty that inflation will inch down to its target range of 1%-3% before it cuts rates.”

--With assistance from Joel Rinneby.