The Bank of England’s shock decision to raise borrowing costs a half percentage point divided business groups, consumer advocates and economists in their reaction.

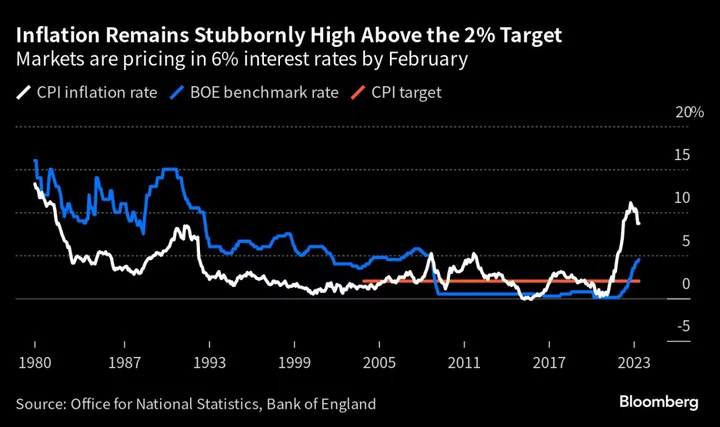

While some have welcomed what appeared to be decisive action to combat sticky inflation, others claimed the UK central bank has condemned the nation to an unnecessary recession.

The remarks underline the difficult position confronting BOE Governor Andrew Bailey and his colleagues on the Monetary Policy Committee. Two of the nine people on the panel voted to leave rates unchanged at 4.5%, arguing that it takes time for rates to work through to the real economy. The others believe price pressures rattling the economy are too persistent to ignore.

Complicating the reaction was the lack of signalling before the vote. The BOE softened its guidance in February and has slowed the pace of rate rises to a quarter for the past two meetings. Just last month, it forecast inflation will fall below target based on prevailing market rates at the time, an indication rates were high enough already.

Few economists forecast a half point rise this week, though most calls were made before Wednesday’s unexpectedly high inflation print. Peter Kinsella, global head of foreign exchange strategy at Union Bancaire Privee, said the half point move “reeks of pure panic.”

“They have clearly disregarded their inflation forecasting framework and are now focused on backward looking data,” Kinsella said. “Today’s reaction says a lot – the pound weakened and gilt yields rose. It’s a classic emerging market style reaction.”

Joseph Little, global chief strategist at HSBC Asset Management, took the opposite stance.

“Today’s decisive action comes at a critical moment for the UK economy,” Little said. “A ‘hawkish super-hike’ comes in the context of widespread recognition that UK policymakers need to ‘get ahead of the curve’.”

Goldman Sachs, which labeled the BOE a “reluctant hiker,” said in a note that the May decision may help stabilize volatile mortgage costs as it should “reassure markets somewhat that the BOE is prepared to raise rates as needed.”

Markets still expect rates to reach 6% but over a quicker period than projected before the rate decision. The reaction suggests the shock increase has not unsettled mortgage pricing any further.

Mortgage rates have soared to near unaffordable levels on fears the BOE has not got inflation under control. Lenders have been pulling deals and aggressively raising rates due to market turbulence.

However, Matt Thompson, head of sales at the estate agent Chestertons, warned that buy-to-let investors may now be forced to sell. Gary Smith, partner at wealth manager Evelyn Partners, warned the rate hike will cause “more mortgage market mayhem.”

Businesses groups also expressed concern.

“Interest rate rises are now causing worry for a rapidly growing number of firms, said Vicky Pryce, a member of the economic advisory council at the British Chambers of Commerce. “There should be absolutely no need to drive the economy into recession in a bid to deal with rising prices. Push too hard on interest rates and there is a real danger that more businesses will be driven to the wall, impacting the long-term outlook for economic growth and prosperity.”

The Joseph Rowntree Foundation said: “This interest rate hike will have serious consequences for more than a million low-income mortgage holders going without essentials like food, clothes or unable to pay their bills.”

Raoul Ruparel, director of Boston Consulting Group’s Center for Growth, said, “The Bank of England finds itself firmly behind the curve and is playing catch up. It is increasingly difficult to see the path to inflation coming down in the UK without a recession.”

--With assistance from Sujata Rao.