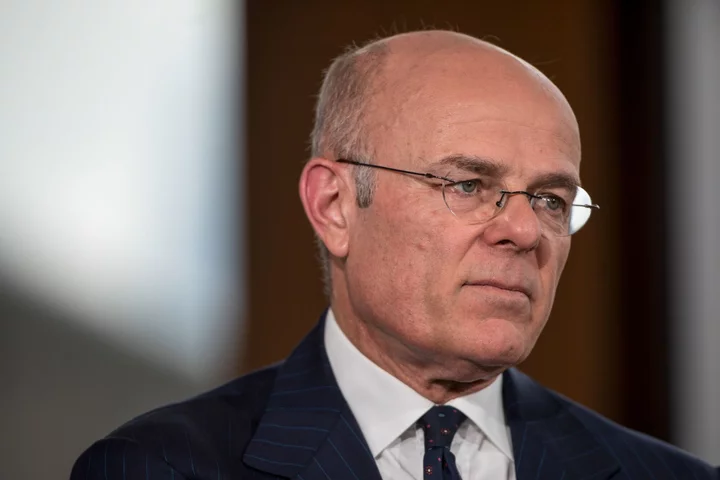

Bank of Canada Governor Tiff Macklem said policymakers may have done enough to tame inflation, reinforcing market and economist expectations that interest rates have peaked.

In his first speech since leaving borrowing costs unchanged in October, Macklem said the economy is expected to remain weak for the next few quarters, which means “more downward pressure on inflation is in the pipeline.”

“This tightening of monetary policy is working, and interest rates may now be restrictive enough to get us back to price stability,” he said, reiterating the central bank is prepared to raise rates again “if high inflation persists.”

Macklem’s remarks came a day after the latest data showed Canada’s consumer price index rose 3.1% in October, the slowest pace since June. A key metric for underlying pressures that policymakers are tracking also slowed to below 3%.

His comments suggest the Bank of Canada has more confidence inflation will continue to decelerate in the coming months as the economy slows, allowing policymakers to keep rates steady at 5%. Officials next set rates in two weeks, and markets and economists expect the central bank will start easing by mid-2024.

“The economy is approaching balance,” Macklem said, according to the prepared text of a speech Wednesday in Saint John, New Brunswick.

Importantly, Macklem suggested Canada’s weakening economy points to a normalization of corporate pricing behavior, a key inflation risk the central bank says it’s closely watching.

“The excess demand in the economy that made it too easy to raise prices is now gone.”

With price-setting behavior stabilizing and the economy returning to balance, wage growth and short-term inflation expectations remain primary concerns.

“We want to see expectations decline to be reassured we are headed back to our 2% target,” he said. “With higher inflation in the last couple of years, we’re seeing more strikes as employers and workers struggle to reconcile rising costs on each side.”

With the economy already showing signs of stagnation, economists expect wage growth and expectations to normalize in coming months. Last month, wage growth slowed to 5%, while the jobless rate rose to 5.7% as population gains outpaced employment growth.

“The past two years have been a painful reminder of how much high inflation hurts households, businesses and communities,” he said. “It’s our common enemy. We want to see high inflation defeated.”

Author: Erik Hertzberg and Randy Thanthong-Knight