The banking industry ramped up lobbying during the second quarter of this year as a financial contagion infected four institutions and increased the threat of additional regulation from Washington.

Lobbying spending from three dozen of the largest banks and the major industry groups increased 19.4% from April through June this year compared to the same quarter last year, according to congressional federal lobbying disclosures that were due late Thursday. The banks spent $19.1 million in the period, compared to less than $16 million a year prior.

The increase in lobbying activity came amid calls for increased scrutiny spurred by crises that undermined confidence in the banking system. In March, crypto-friendly lender Silvergate Capital Corp. collapsed, followed by failures of regional institutions Silicon Valley Bank and Signature Bank. Federal officials shuttered First Republic Bank in May.

Some of the fallout from the banking crisis will come to light next week, with federal regulators set to release new regulations July 27. While the rules had been in-the-works since before the bank failures in the spring, the institutional failures have increased the likelihood regulations will be more stringent and apply to more banks.

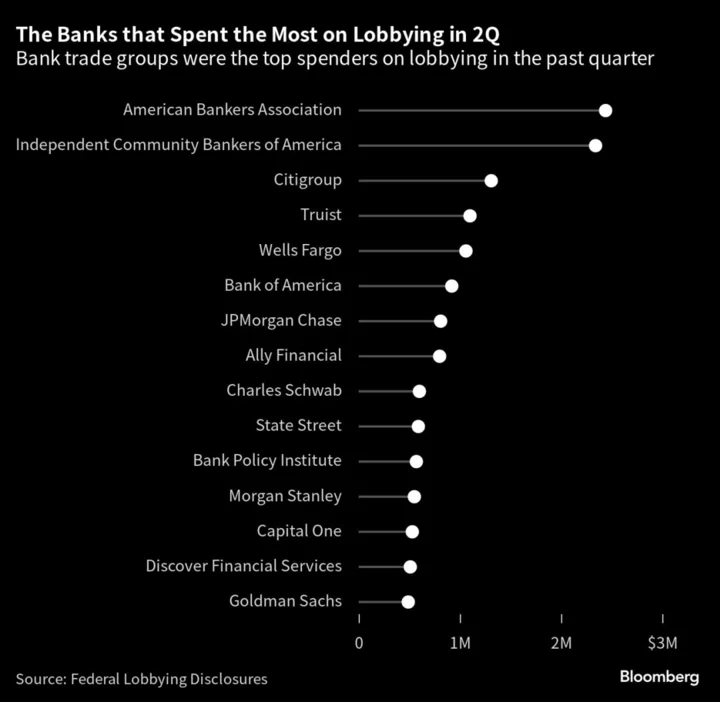

Banking trade groups including the American Bankers Association, which represents banks of all sizes, and the Independent Community Bankers of America, which specifically focuses on smaller institutions, led the industry in total spending in the past quarter. ABA increased spending 33% to $2.4 million from $1.8 million, compared to a year prior. The community bank group nearly tripled spending to $2.3 million from $886,000 in that period.

In times of crisis and when many companies are facing common problems, it’s typical for them to lobby through their trade groups, which can amplify the industry’s position and also shield companies from having to make specific asks that could be politically controversial.

In the first quarter, which covered the first few weeks of the regional banking shock, banks also increased spending on lobbying by nearly 20%, compared to a year prior. The investment in lobbying dropped by the second quarter as the scope of the crisis became clearer but was still up year-over-year.

The data also covers a period of intense lobbying around who would have to pick up the tab for refilling the US government’s bedrock deposit insurance fund after it was tapped to backstop uninsured depositors at Silicon Valley Bank and Signature Bank.

Small lenders, known as community banks, said that they shouldn’t have to foot the bill. Ultimately they won the day. Regulators in May proposed sticking the largest banks with billions of dollars in extra fees, and sparing those with less than $5 billion in assets entirely.

Nearly all of the banks are spending as much or more than they did a year prior on influence in Washington, likely reflecting a reaction to upcoming bank regulations.

Small, medium and regional banks were more likely than the largest banks to increase their spending on a percentage basis. Those banks faced the most heightened threat of regulation after the collapse of peer banks like Silicon Valley Bank and First Republic.

The Federal Reserve, Federal Deposit Insurance Corp. and the Office of the Comptroller of the Currency are poised to release their plan for a sweeping overhaul of bank capital rules next week. Industry titans are already bracing to fight the changes, which are expected to be tougher than global standards.

As part of the effort, earlier this month, Fed Vice Chair for Supervision Michael Barr said he wants Wall Street banks to start using a standardized approach for estimating risks, rather than relying on their own estimates.

He said under the proposal the largest banks would have to hold an extra two percentage points of capital — or an extra $2 of capital for every $100 in risk-weighted assets. Barr also added that new restrictions should apply to banks with $100 billion or more in assets — a move that would subject a broader swath of banks to the toughest standards.

--With assistance from Ben Bain.