Australia’s central bank is set to keep interest rates unchanged at Governor Philip Lowe’s final meeting amid mounting signs that its tightening campaign is slowing inflation without doing too much damage to the economy.

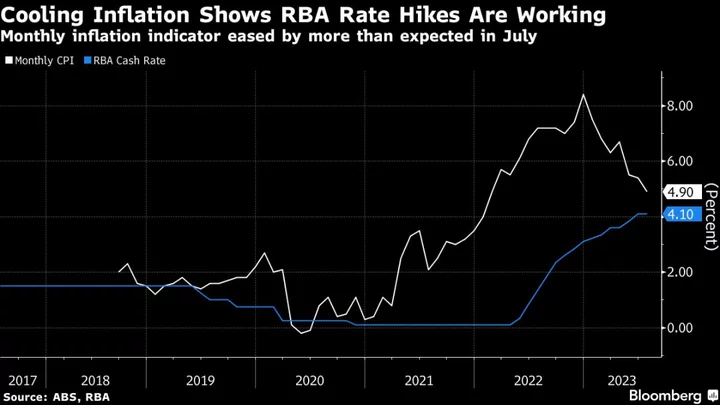

The Reserve Bank will hold its cash rate at 4.1% for a third straight meeting on Tuesday, all-but-one economist predicted, as 11-year high borrowing costs slow demand. Lowe has characterized policy as being in “calibration phase,” whereby the board may make small adjustments in response to economic data.

Latest figures showing the country’s inflation rate came in better than expected at 4.9%, down from a peak of 8.4% in December 2022, suggest that the RBA can stand pat for the time being. Days ago, the Federal Reserve’s preferred measure of underlying inflation posted its smallest back-to-back increases since late 2020.

“There is no catalyst to push the cash rate higher,” said Belinda Allen, a senior economist at Commonwealth Bank of Australia. “The data flow over the past month and the large amount of rate hikes delivered to date make it a clearer decision in September,” unlike the line-ball calls of the previous two meetings.

Lowe has moved more cautiously than developed world peers, having raised rates by 4 percentage points, compared with 5.25 points in New Zealand and the US. The RBA paused at its past two meetings even though price gains remains elevated and are only forecast to fall back within the 2%-3% target in late 2025.

That approach reflects Lowe’s awareness of the heavy debt burden carried by Australian households and his desire to engineer a soft landing in the A$2.3 trillion ($1.5 trillion) economy. The RBA chief wants to preserve pandemic-era labor market gains that were fueled by hefty monetary and fiscal stimulus.

Economists still expect Lowe will run through the case to hike this week and maintain a tightening bias. Incoming Governor Michele Bullock said last week that the bank “may still need to raise rates again,” adding that policymakers will be operating on a month-by-month basis.

Money markets imply a good chance the central bank will be on hold for the rest of the year, with a rate cut only fully priced in by late 2024. Economists reckon the RBA will hike one more time to take the cash rate to 4.35%, with a shallow easing cycle predicted to begin in May next year.

Lowe, like his global counterparts, has been surprised by the resilience of his country’s labor market. Over the past year, unemployment has hovered between 3.5%-3.7%, near levels last seen in Australia in the early 1970s.

The housing market, a key pillar of the economy, has rebounded and corporate profits were strong in the first-half of the year.

Even so, consumer sentiment is in deeply pessimistic territory and retail sales have stagnated over the past year, indicating higher borrowing costs and inflation are already weighing on households.

A day after the RBA meeting, Australia will release gross domestic product data for the three months through June which is likely to show modest economic momentum, with growth largely driven by exports.

On Thursday, Lowe — who steps down Sept. 17 — will give a last speech titled “Some Closing Remarks” in Sydney. The outgoing governor has refused to divulge much on his post-retirement plans, saying only that he’d work to get his golf handicap down to “single digits.”