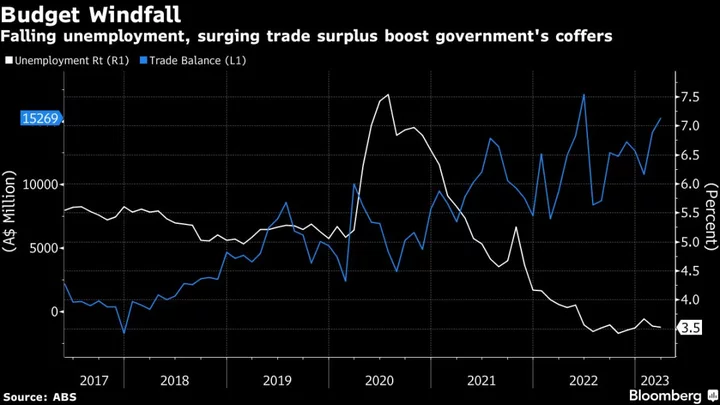

Australia is headed for its first budget surplus since 2008 as windfall tax revenue from a fully employed economy and elevated commodity export prices combine to swell the government’s coffers.

Treasurer Jim Chalmers will forecast a surplus of around A$4 billion ($2.7 billion) in the 12 months through June 2023 when he hands down the budget at 7:30 pm local time Tuesday at Parliament House in Canberra. The document will also show smaller deficits over future years than previously anticipated.

“Our responsible economic management is all about spending restraint, substantial savings redirected to other priorities, and modest but meaningful tax changes,” Chalmers said in a statement Monday. “We are putting the budget on a much more sustainable footing.”

The center-left Labor government is resisting the temptation to spend the windfall revenue and is instead trying to keep fiscal and monetary policy aligned to rein in inflation. Chalmers is betting that prudence now will pay off in two years’ time when he hopes to face an election with prices contained and borrowing costs falling.

As a result, spending measures will be limited and focused on low-income earners and disadvantaged groups hardest hit by rising prices and higher rates.

What Bloomberg Economics Says...

“Surging revenues are likely to drive a temporary surplus in 2022-23, before the budget heads into deficit in future years. Conservative commodity price assumptions are likely to remain in place, driving much of the fiscal deterioration over the forward estimates period.”

— James McIntyre, economist

For the full note, click here

The centerpiece of the budget is A$14.6 billion worth of measures over four years that include relief from high energy costs for households and small business. The budget will also extend support payments for single parents until children are 14-years old, from age 8 at present.

Among revenue measures that will be set out in the fiscal report is a revamping of the Petroleum Resources Rent Tax that’s estimated to raise A$2.4 billion through 2027 by capping generous deductions for the gas industry.

Many observers say the government is going to need to delve deeper into tax reform in order to deal with longer-term budget pressures.

For now, Australia is leaning on potential benefits from a post-pandemic reopening by China, its biggest trading partner, and the warming of ties between Canberra and Beijing. Prospects of a record-high migration is also seen to fuel domestic demand.

Economists surveyed ahead of the budget predict a deficit of 0.8% of gross domestic product in the 12 months through June 2024, with the shortfall widening to 1.5% of GDP the year after that.

“New expenditure near-term will be modest, and some of it may also be temporary, consistent with the treasurer’s message to be fiscally responsible at this stage of the economic and monetary policy cycle,” said said Su-Lin Ong, chief economist and head of fixed-income strategy at Royal Bank of Canada.

--With assistance from Ben Westcott.