Australia’s budget will record a surplus for the first time since the 2008 global financial crisis, before higher interest rates weigh on economic growth and push the government’s books back into the red.

The budget will record a A$4.2 billion surplus in the 12 months through June this year, a remarkable turnaround from a forecast A$36.9 billion deficit in October, Treasury documents showed. Elevated commodity prices and full employment underpinned a surge in tax revenue, and the center-left government has sought to balance fiscal prudence with helping vulnerable Australians.

“In all our decisions, we seek to strike a considered, methodical balance,” Treasurer Jim Chalmers said in his speech to parliament on Tuesday. “Between spending restraint to keep the pressure off inflation, while doing what we can to help people struggling to make ends meet.”

The specter of elevated inflation that has driven the central bank’s yearlong policy tightening cycle is evident in the budget. Chalmers, in resisting the urge to spend much of the windfall revenue, is also trying to tamp down prices in an effort to ensure borrowing costs are on the way down as the Labor government moves into election mode in 2025.

The Reserve Bank has raised its cash rate 11 times to 3.85% — a level not seen since April 2012 — and signaled a willingness to hike further to ensure consumer prices return to its 2-3% target. Those hikes will slow economic growth sharply and push up unemployment, which combined with weaker commodity prices pushes the government’s books back into the red.

The budget forecasts a deficit of A$13.9 billion, or 0.5% of GDP, in fiscal 2024. The shortfall then swells to A$35.1 billion, or 1.3% of GDP, the following year and peaks at A$36.6 billion in 2025-26.

Australia’s outlook is still well ahead of Group of 20 counterparts, whose average budget deficit is forecast to climb to 5% of GDP this year, according to the International Monetary Fund. The US budget deficit is currently 6.9% of GDP while fiscally cautious Germany’s is at 2.6%, according to data compiled by Bloomberg.

Chalmers’ restrain is likely to see Australia retain its coveted AAA credit rating from the three major companies, a status held by only a handful of nations.

At the same time, Chalmers has pledged A$14.6 billion in cost-of-living relief for Australian households who are struggling with price rises on everything from electricity, to groceries and hospital bills. This includes boosting benefits for single parents and additional support for renters and the unemployed.

“Our policies to ease the pressure on households will take three quarters of a percentage point off inflation in 2023-24,” Chalmers said in his speech. Treasury forecasts inflation will cool to 3.25% next fiscal year, from an estimated 6% this year.

But in order to slow inflation, economic growth is also set to decelerate sharply. Treasury forecasts GDP will rise 1.5% in the 12 months ending June 2024, down from 3.25% this year. The jobless rate is seen climbing to 4.25% next fiscal year from 3.5% at present.

Chalmers acknowledged the fiscal picture will be challenging in the years ahead amid a global economy that’s also struggling. In addition, Australia’s aging population and rising demand for services like health will increase budget costs.

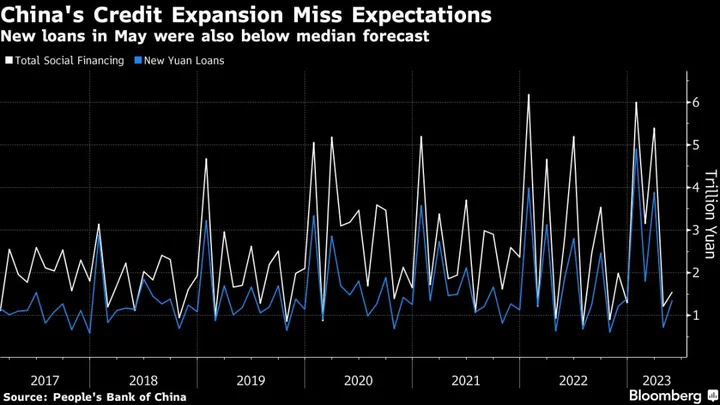

One upside for Australia is a sharp rebound in its biggest trading partner, China. Treasury said the world’s second-largest economy will expand 5.75% in 2023, or “comfortably above” Beijing authorities’ 5% target.

The budget also aims to spur new industries in the local economy, including a A$4 billion outlay to help Australia become a “renewable energy superpower” and A$2 billion to make the country a “world leading” hydrogen producer.

That will see gross debt rise to above A$1 trillion by 2025-26 as expenses are seen rising at a faster pace than revenue, which will largely be driven by personal income taxes, followed by company and resource rent taxes.