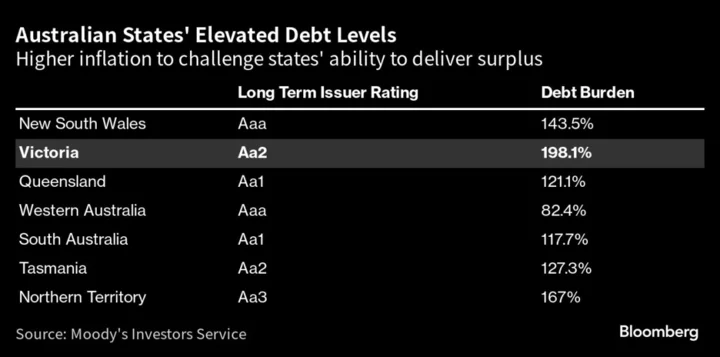

Australia’s two biggest states will struggle to return their budgets to surplus as the economy sags under central bank rate hikes that also sent government borrowing costs soaring, according to ratings agency Moody’s Investors Service.

“New South Wales and Victoria, which were most heavily impacted by COVID-19, continue to suffer from the lingering fiscal impact as they both look to manage the delivery of their respective election spending commitments, sticky cost pressures and higher residual debt burdens,” John Manning, senior credit officer at Moody’s, wrote in a report this week. Western Australia and Queensland enjoy windfall revenue gains underpinned by strong high commodity prices.

Victoria’s decision to cancel the 2026 Commonwealth Games due to cost overruns highlighted the bind that provincial governments face as political commitments to ambitious infrastructure programs become harder to meet with revenues set to fall and bond yields at the highest in 10 years.

Yields on New South Wales’ 5-year bond have more than doubled since 2022, when the Reserve Bank of Australia kicked off its post-pandemic tightening cycle. They dropped 9 basis points Thursday to 4.19%, matching the decline in the Australian government five-year note, according to Bloomberg-compiled data.

Victoria’s 5-year yield has also more than doubled since 2022. It fell 9 basis points to 4.2% on Thursday.

New South Wales and Victoria account for just over half of Australia’s economy between them. Australia’s states have near-record levels of infrastructure projects, exacerbating the already-tight labor market and shortage of construction materials in the next four years.

Australia’s Cooler Inflation Boosts Case to Pause Rate Again

“We expect such supply chain constrains, particularly labor, will remain over the next two to three years as many large projects approach peak construction,” he said.

Victoria’s debt burden is expected to jump to 226% of operating revenues by 2027 from 147% in 2022 — and the decision to cancel the Games will be of little help, Moody’s said. New South Wales will see its burden rise to 152% by 2026 from 103% in 2022. The two states are currently running operating deficits to fund their infrastructure pipeline and higher borrowing costs.

“We have seen fiscal discipline in the non-commodity exposed states wane in the last two, three years,” said Anthony Walker, director, sovereign & international public finance ratings at S&P Global Ratings. “It has been easier to give money than it is to cut back on spending.”

(Updates with bond data in fourth and fifth paragraphs)