Asian equities look poised for a weak open as investors contend with the prospect of global interest rates staying at their highest levels in decades.

Futures for Japanese shares slipped 0.2%, while those for Australia dropped 0.5%. Contracts for Hong Kong and mainland Chinese stocks both fell at least 0.6%. The dollar opened mixed. A number of Australian states, including New South Wales, are shut Monday for holidays.

US stocks declined 0.3% Friday amid concern over a possible shutdown of the US government. While markets may take some early relief from a last-minute spending deal, attention will quickly shift to US manufacturing activity and jobs data this week after the head of the Federal Reserve Bank of New York said Friday policy makers should leave interest rates high for some time.

“Financial markets were bracing for a shutdown, so there’s an element of relief, but it’s only a temporary lifting of one of the clouds hanging over the markets now,” said Yung-Yu Ma, chief investment officer at BMO Wealth Management. “Interest rates and Fed hawkishness remain the name of the game and the main driver of the markets over the next few weeks.”

Read more: Traders Win Reprieve After ‘Political Circus’ of Shutdown Fight

A weak opening on the first trading day of October would extend a torrid period for global financial markets. Elevated interest rates made the July-to-September quarter the worst for MSCI’s all-country stock index since September 2022 as surging oil prices added fears over inflation and slowing economic growth. Bonds meanwhile had their biggest monthly selloff in September since February

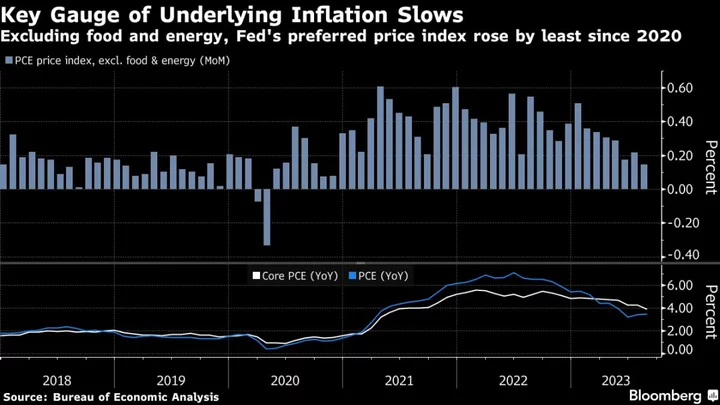

While global interest rates may be close to their peaks, central banks are being hard-pressed to walk a fine line between reining in rising prices and skirting a recession. Fed chief Jerome Powell and his European Central Bank counterpart Christine Lagarde are both due to speak in the coming week and investors will scrutinize any reaction from them following data that suggested inflation has markedly slowed.

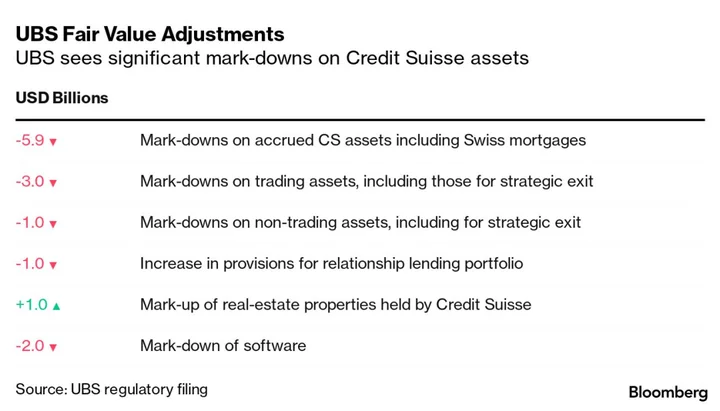

“Unless we get a clearly changed message from the key central banks – urgently — these past few weeks’ big market moves are unlikely to be over,” said Erik Nielsen, chief economics advisor at UniCredit Group. “The combination of high yields and zero growth typically raises concerns about financial stability, and while the key financial institutions are stronger today than in the past, it would be foolish to dismiss the rising risk.”

Read more: Once Unthinkable Bond Yields Now the New Normal For Markets

Some of the main moves in markets:

Stocks

- S&P 500 futures fell 0.3% as of 5:47 a.m. Tokyo time

- Hang Seng futures fell 0.7%

- S&P/ASX 200 futures fell 0.5%

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro was little changed at $1.0571

- The Japanese yen fell 0.2% to 149.61 per dollar

- The offshore yuan fell 0.1% to 7.3006 per dollar

- The Australian dollar fell 0.2% to $0.6424

Cryptocurrencies

- Bitcoin rose 0.2% to $27,116.88

- Ether fell 0.3% to $1,674.45

Bonds

- The yield on 10-year Treasuries was little changed at 4.57% on Friday

- Japan’s 10-year yield advanced one basis point to 0.765%

- Australia’s 10-year yield advanced three basis points to 4.49%

Commodities

- West Texas Intermediate crude fell 1% to $90.79 a barrel

- Spot gold fell 0.9% to $1,848.63 an ounce

This story was produced with the assistance of Bloomberg Automation.