Asian equities were poised for a cautious open while the dollar traded in narrow ranges versus its major peers early Monday as investors weighed the Federal Reserve’s higher-for-longer stance.

Futures for Japanese shares were flat and those for Australia declined slightly. Contracts for Hong Kong stocks also dipped while an index of US-listed Chinese companies rose on news that Washington and Beijing are forming working groups to discuss economic and financial issues.

S&P 500 futures were up 0.2% in early Asian trading after the index fell by the same amount on Friday to cap its worst week since March. Nasdaq 100 futures advanced 0.2% after the underlying gauge ended little changed Friday, supported by gains in Apple Inc. as its latest iPhones and watches went on sale.

Treasuries, which managed a modest rebound on Friday, will be in focus again this week, with Fed officials speaking at public events. Investors will also be watching the release of a key inflation gauge in the US, and assessing the likely impact of a possible US government shutdown.

Traders are still very concerned about inflation and the path of policy amid the recent oil rally and the Fed’s signal that rates are not going to come down any time soon, according to Fawad Razaqzada, a market analyst at City Index and Forex.com.

“It is far too early to say the markets have bottomed, as fundamentally nothing has changed,” Razaqzada noted.

Two Fed officials said at least one more rate hike is possible and that borrowing costs may need to stay higher for longer for the central bank to ease inflation back to its 2% target. While Boston Fed President Susan Collins said further tightening “is certainly not off the table,” Governor Michelle Bowman signaled that more than one increase will probably be required, cementing her position as one of the Federal Open Market Committee’s most hawkish members.

Fed Bank of San Francisco President Mary Daly said she is not ready to declare victory in the fight against inflation, and that the central bank is still committed to curbing price pressures “as gently as possible.”

The yield on 10-year Treasuries could reach 4.75% before softer risk sentiment and tighter financial conditions push it lower into year-end, according to rates strategists at Bank of America Corp.

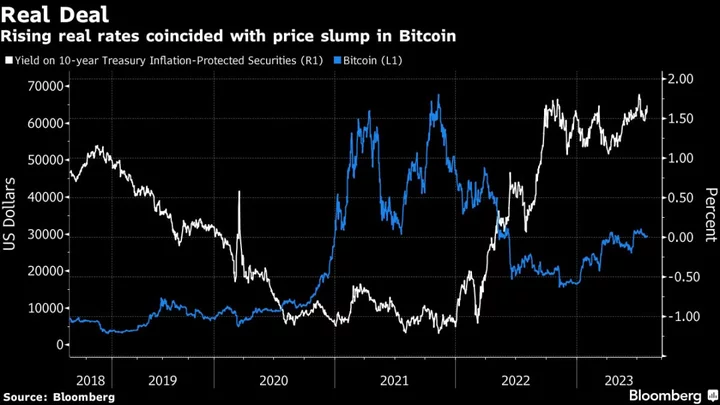

Elsewhere in markets, oil rose back toward its year high. Bitcoin was little changed around $26,500.

Key events this week:

- Minneapolis Fed President Neel Kashkari in Q&A, Monday

- ECB’s Francois Villeroy de Galhau speaks on monetary policy, Monday

- US new home sales, Conference Board consumer confidence, Tuesday

- ECB’s Philip Lane speaks on monetary policy, Tuesday

- China industrial profits, Wednesday

- US durable goods, Wednesday

- Eurozone economic confidence, consumer confidence, Thursday

- US initial jobless claims, GDP, Thursday

- Fed Chair Jerome Powell town hall meeting with educators while Richmond Fed President Tom Barkin, Chicago Fed President Austan Goolsbee make speeches, Thursday

- Eurozone CPI, Friday

- Japan unemployment, industrial production, retail sales, Tokyo CPI, Friday

- US consumer spending, wholesale inventories, University of Michigan consumer sentiment, Friday

- ECB President Christine Lagarde speaks, Friday

- New York Fed President John Williams speaks, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures rose 0.2% as of 7:09 a.m. Tokyo time. The S&P 500 fell 0.2%

- Nasdaq 100 futures 0.2%. The Nasdaq 100 was little changed

- Nikkei 225 futures were little changed

- Australia’s S&P/ASX 200 Index futures fell 0.3%

- Hang Seng Index futures fell 0.3%

Currencies

- The euro was little changed at $1.0649

- The Japanese yen was little changed at 148.36 per dollar

- The offshore yuan was little changed at 7.2983 per dollar

- The Australian dollar was little changed at $0.6443

Cryptocurrencies

- Bitcoin was little changed at $26,507.63

- Ether fell 0.1% to $1,588.81

Bonds

- The yield on 10-year Treasuries declined six basis points to 4.43% Friday

Commodities

- West Texas Intermediate crude rose 0.2% to $90.25 a barrel

This story was produced with the assistance of Bloomberg Automation.

--With assistance from Rita Nazareth.