Asian shares were poised for a mixed opening, with the region’s focus turning to China’s growing signs of economic malaise after the tech sector led US stocks higher overnight.

Japanese futures point to a rise in early trading, with Hong Kong stocks set to edge down and Australia looking flat. A gauge of Chinese stocks listed in Hong Kong slumped again on Monday and is now the worst performer this month among 92 global equity measures tracked by Bloomberg.

In light trading overnight, tech stocks had their best day in two weeks as traders weighed the prospect of a soft landing for the US economy. The Nasdaq 100 rose 1.2% as AI-favorite Nvidia Corp. and other technology giants drove Monday’s advance. On Friday, the tech-heavy benchmark had notched its first back-to-back weekly losing streak this year and is down 3.5% this month. Smaller stocks were under pressure Monday, with the Russell 2000 touching the lowest in a month.

Treasury yields wavered before ticking higher as high-grade corporate bond sales weighed on prices. The policy sensitive two-year advanced for the fourth day to approach 5%, while the 10-year climbed to 4.21%, the highest since November.

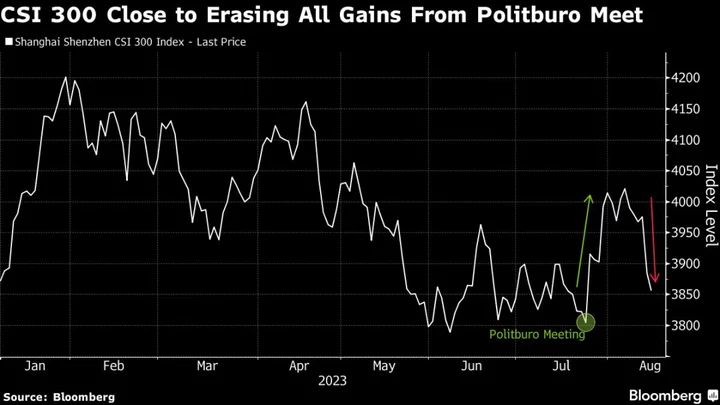

Even as Wall Street looks subdued during the usual August lull, tension is building in China’s financial markets as red flags pop up throughout the world’s second-biggest economy, but particularly in the long-troubled property sector. Debt concerns at developer Country Garden Holdings Co. saw its shares plunge 18% after closing below HK$1 for the first time ever last week.

The offshore yuan touched its weakest level this year on Monday. Other woes include missed payments by one of the nation’s largest private wealth managers, unprecedented losses at China-focused hedge funds and the threat of deflation. While that’s intensifying pressure on policymakers to act, so far investors have been underwhelmed by Beijing’s measures to shore up the economy.

“The more days that go by without a comprehensive fiscal stimulus plan the more clear it becomes there will not be one,” Brad Bechtel, a Jefferies strategist said of China’s central bank. “The big bazooka is not coming.”

Back in the US, traders are betting interest rates will outpace inflation for years to come. The greenback strengthened on Monday.

Focus later this week will be on minutes of the Federal Reserve’s latest policy meeting as traders seek clues on the central bank’s next move. Investors who’d bet on a pivot to easier policy this year are having to adjust their bets as officials signal they will keep interest rates higher for longer.

August is typically a slow month due to low liquidity and moves in either direction should not be taken seriously, according to Jason Draho, head of asset allocation Americas at UBS Global Wealth Management.

“The fundamental outlook for the US economy hasn’t materially changed in the past two weeks,” Draho wrote. “Investors should take any data point or two and week-to-week market moves with a grain of salt, especially during the summer slowdown.”

In emerging markets, Argentina’s already-distressed debt sagged after a populist who vowed to burn down the central bank won surprisingly strong support in a primary vote. Its under siege government submitted to a 18% currency devaluation. In commodities, gold and crude slumped.

Read more: Out of Options and Money, Argentina Presses the Panic Button

Corporate Highlights:

- Hawaiian Electric Industries Inc. plunged by a record 34% on concern that its power lines may be linked to the deadly Maui wildfires.

- US Steel Corp. surged 37% after the company got a rival $7.8 billion takeover offer from Esmark Inc. following peer Cleveland-Cliffs Inc.’s unsolicited bid.

- Tesla Inc. slipped 1.2%, triggering a selloff for other producers of electric vehicles, after it rolled out a new round of price cuts in China.

- Nikola Corp. plummeted after the manufacturer announced it will recall trucks and temporarily stop sales after several battery fires.

Key events this week:

- China medium-term lending, retail sales, industrial production, fixed-asset investment, FX net settlement, Tuesday

- Japan industrial production, GDP, Tuesday

- UK jobless claims, unemployment, Tuesday

- US retail sales, empire manufacturing, business inventories, cross-border investment, Tuesday

- Reserve Bank of Australia policy minutes, Tuesday

- Federal Reserve Bank of Minneapolis President Neel Kashkari speaks, Tuesday

- China property prices, Wednesday

- Eurozone industrial production, GDP, Wednesday

- UK CPI, Wednesday

- US FOMC minutes, housing starts, industrial production, Wednesday

- US initial jobless claims, US Conf. Board leading index, Thursday

- Eurozone CPI, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures were little changed as of 7:08 a.m. Tokyo time. The S&P 500 rose 0.6%

- Nasdaq 100 futures were little changed. The Nasdaq 100 rose 1.2%

- Australia’s S&P/ASX 200 Index futures were unchanged

- Hang Seng Index futures fell 0.3%

- The Russell 2000 Index rose 0.5%

Currencies

- The Bloomberg Dollar Spot Index rose 0.3%

- The euro was unchanged at $1.0906

- The yen was little changed at 145.53 per dollar

- The offshore yuan was little changed at 7.2792 per dollar

Cryptocurrencies

- Bitcoin was little changed at $29,391.68

- Ether was little changed at $1,843.8

Bonds

- The yield on 10-year Treasuries advanced four basis points to 4.19%

- Australia’s 10-year yield advanced eight basis points to 4.20%

Commodities

- West Texas Intermediate crude was little changed

- Spot gold was little changed

This story was produced with the assistance of Bloomberg Automation.