Asian markets were mixed Monday ahead of US debt talks between President Joe Biden and congressional leaders, with both sides still apart but also confident a deal can be reached to avert a catastrophic default.

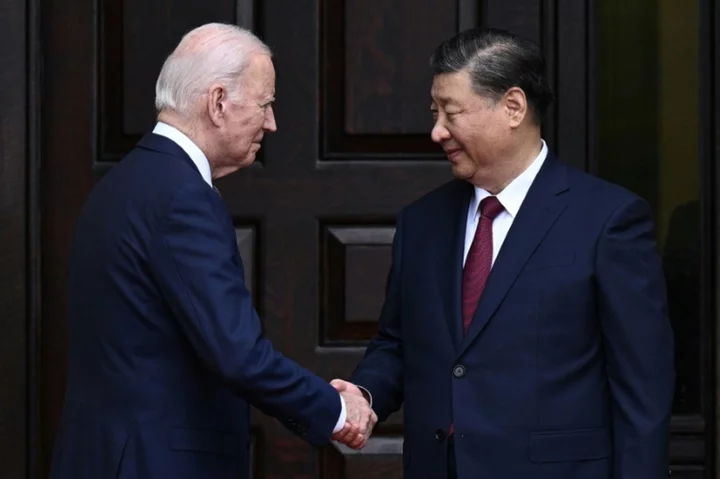

After returning from the G7 summit in Japan, Biden will meet Republican House Speaker Kevin McCarthy at the White House, with a warning that the government could run out of cash as soon as June 1.

But while there is a broad expectation that an agreement will be found, Biden insisted he would not give in to demands for spending cuts, saying they were "frankly unacceptable".

"It's time for the other side to move from their extreme positions," he said.

For his part, McCarthy said his position remained unchanged, tweeting: "Washington cannot continue to spend money we do not have at the expense of children and grandchildren."

However, after speaking to Biden, he told reporters: "I believe it was a productive phone call."

Still, the stalled talks caused last week's rally in US stocks to stumble Friday.

Asia fared a little better Monday, though markets fluctuated as investors awaited solid signs of a compromise out of Washington.

Hong Kong and Shanghai edged up along with Tokyo and Seoul. But Sydney, Singapore, Taipei, Manila, Jakarta and Wellington slid.

"It seems pretty likely that a full-fledged deal will be reached before early June, but the timing is hard to predict," said SPI Asset Management's Stephen Innes.

"While negotiation strategy and political incentives imply a last-minute deal, we will soon find out if it's baked beans or lobster during the Memorial Day holiday."

Sentiment was buoyed by hopes the Federal Reserve will not lift interest rates at its June policy meeting after boss Jerome Powell hinted at a pause after more than a year of tightening.

"We've come a long way in policy tightening and the stance of policy is restrictive and we face uncertainty about the lagged effects of our tightening so far and about the extent of credit tightening from recent banking stresses," he said Friday.

"Having come this far, we can afford to look at the data and the evolving outlook to make careful assessments."

Bets on a softer approach to tightening have risen after turmoil in the banking sector that was blamed on the Fed's sharp rate hikes.

Nationwide Life Insurance's Kathy Bostjancic said Powell's remarks "indicate his baseline view is to pause in June to assess incoming data" but that could change if inflation figures come in above forecasts.

And Chris Weston, at Pepperstone Group, added in a note: "Market pricing is firmly back to thinking the Fed will pause.

"The US debt ceiling, and the price action in US banks, are going to dominate the narrative."

- Key figures around 0230 GMT -

Tokyo - Nikkei 225: UP 0.1 percent at 30,833.94 (break)

Hong Kong - Hang Seng Index: UP 1.4 percent at 19,719.00

Shanghai - Composite: UP 0.5 percent at 3,298.40

Euro/dollar: UP at $1.0822 from $1.0810 on Friday

Pound/dollar: UP at $1.2459 from $1.2448

Dollar/yen: DOWN at 137.68 yen from 137.94 yen

Euro/pound: UP at 86.87 pence from 86.82 pence

West Texas Intermediate: DOWN 0.6 percent at $71.25 per barrel

Brent North Sea crude: DOWN 0.6 percent at $75.12 per barrel

New York - Dow: DOWN 0.3 percent at 33,426.63 (close)

London - FTSE 100: UP 0.2 percent at 7,756.87 (close)

dan/qan