Asian equity futures drifted lower as US stocks fell following economic data that exceeded forecasts, bolstering the case for the Federal Reserve to keep interest rates elevated for longer.

Contracts for share benchmarks in Japan and Australia dropped, while those for Hong Kong equities were flat. The S&P 500 fell 0.7% to close lower for a second day. The tech-heavy Nasdaq 100, which is more sensitive to interest rate expectations, declined 0.9%. US futures were little changed in early Asian trading.

Treasuries also retreated, pushing yields higher. Two-year yields rose around six basis points to climb above 5%, while the 10-year yield rose two basis points.

The Institute for Supply Management’s US services index for August reached 54.4, its highest monthly reading since February and one that topped all estimates in a Bloomberg survey of economists. A reading above 50 denotes growth.

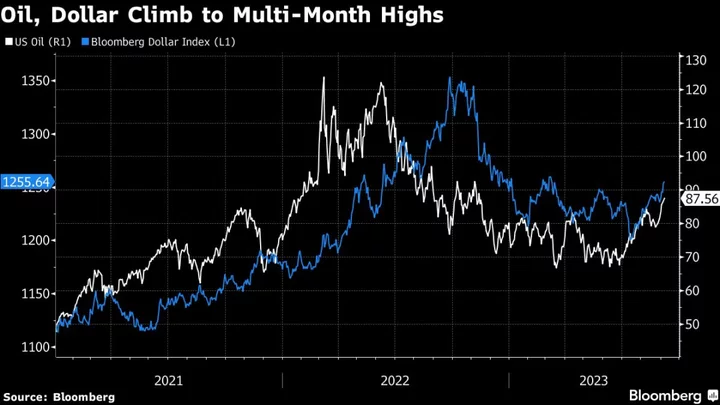

The data supported the view the Fed has one rate hike left this year, adding upward pressure to the dollar Wednesday. The Bloomberg dollar index rose again to set a fresh six-month high. Currency markets were broadly flat early Thursday with investors keenly watching the yen and yuan after stretches of weakness.

“The ISM Services Sector report underscores the resilience of the largest portion of the economy,” said Quincy Krosby, chief global strategist at LPL Financial, who pointed to higher prices shown within the data. “This is is certainly not good news for a data-dependent Fed.”

In Asia, China will release foreign reserves and trade data. Malaysia is expected to keep rates on hold at 3%. Reserve Bank of Australia’s outgoing Chairman Philip Lowe will speak, as will Bank of Japan board member Junko Nakagawa.

Oil clung to a Wednesday gain, extending a run of nine daily advances. West Texas Intermediate has risen around a fifth in the past three months to edge closer toward $90 per barrel.

Elsewhere, the pound slid after Bank of England Governor Andrew Bailey suggested UK rates may not have to rise any further. The Canadian dollar was little changed after the Bank of Canada held rates steady.

Key events this week:

- China trade, forex reserves, Thursday

- Eurozone GDP, Thursday

- US initial jobless claims, Thursday

- Bank of Canada Governor Tiff Macklem to speak on the Economic Progress Report, Thursday

- Atlanta Fed President Raphael Bostic speaks, Thursday

- New York Fed President John Williams participates in moderated discussion at the Bloomberg Market Forum, Thursday

- Japan GDP, Friday

- Germany CPI, Friday

- US wholesale inventories, consumer credit, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures were little changed as of 7:38 a.m. Tokyo time. The S&P 500 fell 0.7%

- Nasdaq 100 futures were little changed. The Nasdaq 100 fell 0.9%

- Nikkei 225 futures fell 0.3%

- Hang Seng futures rose 0.1%

- S&P/ASX 200 futures fell 0.5%

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro was little changed at $1.0725

- The Japanese yen was little changed at 147.60 per dollar

- The offshore yuan was little changed at 7.3201 per dollar

- The Australian dollar was little changed at $0.6384

Cryptocurrencies

- Bitcoin rose 0.3% to $25,747.84

- Ether rose 0.3% to $1,631.93

Commodities

- West Texas Intermediate crude was little changed

- Spot gold was little changed

This story was produced with the assistance of Bloomberg Automation.