Asian stocks are poised to open higher after US equities were buoyed by Wall Street scaling back wagers on Federal Reserve rate hikes. Oil edged lower, following its biggest rally since April.

Futures on benchmarks in Australia, Japan and Hong Kong all rose. The S&P 500 gained for a third day, approaching the 4,400 level. Amazon.com Inc. rose amid its fall sale for Prime subscribers and PepsiCo Inc. climbed on a bullish forecast. Wall Street’s fear gauge, the CBOE Volatility Index or VIX, fell to a two-week low.

The Golden Dragon index of Chinese companies listed in the US climbed the most in more than a month as Bloomberg News reported the Asian nation is considering new economic stimulus.

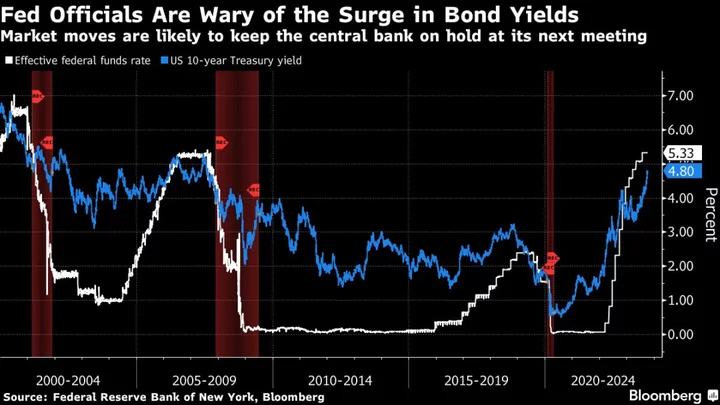

Treasuries gained after comments from Fed officials bolstered speculation the central bank is headed toward another pause in rate increases. Yields posted some of their their biggest one-day declines all year, with 10-year yields tumbling 15 basis points to 4.65% as trading resumed in the cash market.

Fed swaps currently show about a 60% chance the Fed will stay on hold in December, compared with 60% odds on another hike by then, just a week ago. The dollar fell for a fifth straight day, its longest losing streak since July. Oil slipped, with West Texas Intermediate settling below $86 a barrel after jumping more than $3 on Monday.

Fed Bank of Atlanta President Raphael Bostic said policy is restrictive enough to lower prices to the 2% goal. His Minneapolis counterpart Neel Kashkari said he wasn’t yet convinced that a surge in long-term Treasury yields would lessen the need for further rate hikes, saying it depends on what is driving the recent rise in borrowing costs.

“Policymakers have begun to acknowledge a lesser need for further policy action given financial conditions have tightened considerably after the recent surge in Treasury yields,” said Ben Jeffery at BMO Capital Markets. “This acknowledgment may have reduced angst around the need for additional rate increases.”

Investors will be watching for any hints in the September Fed meeting minutes due Wednesday that would suggest the Fed may not follow through with the last hike indicated in its economic projections, according to Anna Wong at Bloomberg Economics. Two critical upcoming economic indicators — Thursday’s consumer price index and Friday’s University of Michigan consumer-sentiment survey — may give a more definitive read, she noted.

Read: US Consumers See Higher Near-Term Inflation, Tighter Credit

Global investors also kept a close eye on geopolitics. President Joe Biden said the US is “surging” military assistance to Israel in the wake of the Palestinian militant group Hamas’ surprise attack.

Billionaire investor Paul Tudor Jones told CNBC the current geopolitical environment is the “most threatening and challenging” he’s ever seen in the wake of Hamas’s attack on Israel over the weekend and predicted the US will enter into a recession early next year.

Key events this week:

- Germany CPI, Wednesday

- NATO defense ministers meeting in Brussels, Wednesday

- Russia Energy Week in Moscow, with officials from OPEC members and others, Wednesday

- US PPI, Wednesday

- Minutes of Fed’s September policy meeting, Wednesday

- Fed’s Michelle Bowman and Raphael Bostic speak at separate events, Wednesday

- Japan machinery orders, PPI, Thursday

- Bank of Japan’s Asahi Noguchi speaks, Thursday

- UK industrial production, Thursday

- US initial jobless claims, CPI, Thursday

- European Central Bank publishes account of September policy meeting, Thursday

- Fed’s Raphael Bostic speaks, Thursday

- China CPI, PPI, trade, Friday

- Eurozone industrial production, Friday

- US University of Michigan consumer sentiment, Friday

- Citigroup, JPMorgan, Wells Fargo, BlackRock results as the quarterly earnings season kicks off, Friday

- G20 finance ministers and central bankers meet as part of IMF gathering, Friday

- ECB President Christine Lagarde, IMF Managing Director Kristalina Georgieva speak on IMF panel, Friday

- Fed’s Patrick Harker speaks, Friday

Some of the main moves in markets as of 6:41 a.m. Tokyo time:

Stocks

- The S&P 500 rose 0.5%

- The Nasdaq 100 rose 0.6%

- Nikkei 225 futures rose 0.2%

- Hang Seng futures rose 0.6%

- S&P/ASX 200 index rose 0.4%

Currencies

- The Bloomberg Dollar Spot Index fell 0.3%

- The euro was little changed at $1.0606

- The yen was unchanged at 148.71 per dollar

Cryptocurrencies

- Bitcoin rose 0.2% to $27,447.06

- Ether rose 0.4% to $1,566.6

Bonds

- The yield on 10-year Treasuries declined 15 basis points to 4.65%

Commodities

- Spot gold was little changed

This story was produced with the assistance of Bloomberg Automation.

--With assistance from Rita Nazareth and Liz Capo McCormick.