Stocks in Asia followed US benchmarks higher ahead of a slew of Chinese data, after strong US economic reports revived speculation the Federal Reserve will be able to engineer a soft landing.

Equities in Australia rallied the most in two weeks while Japanese and Korean shares also climbed. Futures in Hong Kong advanced and contracts for US stocks rose following gains on the S&P 500 and Nasdaq 100 on Thursday as retail sales and producer prices beat estimates. The dollar was steady while the euro remains at its lowest level in five months after the European Central Bank likely hiked for a final time and downgraded growth forecasts on Thursday.

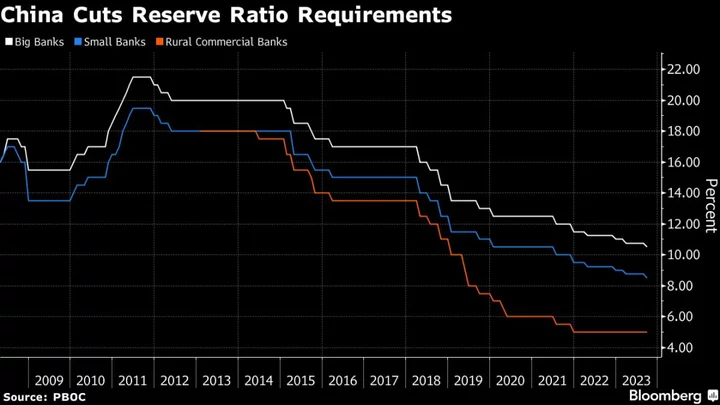

Investors now turn their attention to economic data out of China after the nation’s central bank cut the amount of cash lenders must hold in reserve for the second time this year. The People’s Bank of China may also catch the market off guard again on Friday with a 10-basis-point MLF rate cut, the first time it has cut the rate back-to-back, according to Bloomberg Economics.

“Risk markets are in a more buoyant mood at the end of this week, following a dovish ECB rate hike, an inline US inflation report and strong consumer spending and labour market data,” said Tony Sycamore, an analyst at IG in Sydney. “In China today, IP and Retail Sales are the key ones to keep an eye on, and given they are expected to see an improvement in both, it looks markets should remain firm into the weekend.”

The S&P 500 and Nasdaq rose 0.8% apiece while the Dow Jones Industrial Average surged almost 1% on Thursday. The better than expected US data reinforced the view that the US economy is headed for a period of moderate growth, avoiding a recession over the coming 12 months, according to Solita Marcelli, chief investment officer for the Americas at UBS Global Wealth Management.

“That should support equities,” she noted. “However, uncertainty is likely to keep broad equity markets choppy.”

Meanwhile, Arm Holdings Plc surged 25% in its trading debut. Ford Motor Co. and General Motors Co. underperformed, with Detroit carmakers facing the threat of a strike. Traders also braced for Friday’s triple witching options event — which has the potential to trigger volume spikes and volatility.

US Treasury yields edged lower in Asia, paring Thursday’s rise. Bond traders have spent most of the last two months worrying about persistent inflation and an economy that seems to be running hot, according to Chris Zaccarelli, chief investment officer at Independent Advisor Alliance. The most-recent economic data just reinforced that, he said.

“The Fed has indicated that they want to slow down the pace of rate increases, and for that reason they are still likely to keep rates unchanged at next week’s meeting, but all of the data that is coming in higher than expected is going to put pressure on them to raise rates again at the following meeting,” Zaccarelli added.

Read More: Atlanta Fed GDP Now Downshifts, Adds to Case for Soft Landing

In commodities, oil’s rally above $90 a barrel is the latest milestone in a surge driven by output cuts from Saudi Arabia and Russia amid record global consumption and follows reports this week warning of tightness in the coming months. Futures advanced in early trading on Friday, but with prices soaring more than 30% since late June, traders are bracing for a potential pullback.

Key events this week:

- China property prices, retail sales, industrial production, Friday

- US industrial production, University of Michigan consumer sentiment, Empire Manufacturing index, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures rose 0.1% as of 9:38 a.m. Tokyo time. The S&P rose 0.8% Thursday

- Nasdaq 100 futures rose 0.1%. The Nasdaq 100 rose 0.8%

- Japan’s Topix rose 1%

- Australia’s S&P/ASX 200 rose 1.6%

- Euro Stoxx 50 futures rose 0.4%

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro was little changed at $1.0641

- The Japanese yen was little changed at 147.40 per dollar

- The offshore yuan was little changed at 7.2922 per dollar

- The Australian dollar was little changed at $0.6445

Cryptocurrencies

- Bitcoin fell 0.1% to $26,550.32

- Ether was little changed at $1,629.46

Bonds

- The yield on 10-year Treasuries declined one basis point to 4.28%

- Australia’s 10-year yield declined one basis point to 4.10%

Commodities

- West Texas Intermediate crude rose 0.6% to $90.74 a barrel

- Spot gold was little changed

This story was produced with the assistance of Bloomberg Automation.