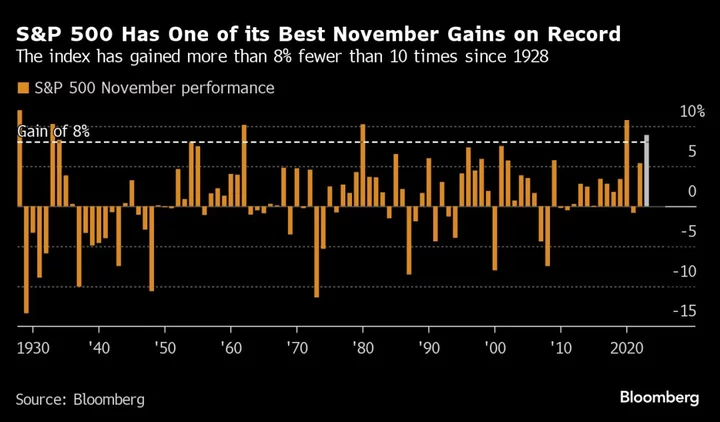

Shares in Asia opened mixed after Wall Street saw a late-day rebound in trading, helping the S&P 500 notch one of its biggest November rallies on record. Recent gains in Treasuries stalled.

Equities in Japan advanced while those in Australia and South Korea fell. Equity futures for Hong Kong edged higher. The S&P 500 climbed 0.4% Thursday, capping one of its best November returns in the past century, and closing within 5% of its 2022 peak. US futures pointed slightly lower early Friday.

The 9.1% November gain for the MSCI All Country World Index is the best since the same month two years ago — and the third largest monthly gain in the past decade.

The equity rally was helped along by speculation the Federal Reserve’s rate-hike cycle has peaked, an idea hinted at by central bank officials through the week.

“Almost everyone was offsides coming into November,” said Ryan Detrick, chief market strategist at Carson Group. “So there’s still a big opportunity for traders to chase gains in December, too.”

Those signals presage comments from Fed Chair Jerome Powell, who will speak later Friday, in a discussion that may offer more clues.

“It is still too early to eliminate the tightening bias in the Fed’s forward guidance,” said Brian Rose, senior US economist at UBS Global Wealth Management. “Fed Chair Jerome Powell will make a public appearance on Friday, and we expect him to be careful to avoid sounding too dovish.”

Data has also helped. The US core personal consumption expenditures price index, the Fed’s preferred gauge of underlying inflation, fell, indicating easing price pressures in line with economists’ estimates. That followed evidence from the labor market and consumer spending indicating growth is gradually slowing.

“We’ve seen continuous evidence that inflation is in fact falling quickly — it’s kind of collapsing right now,” said Scott Ladner, chief investment officer for Horizon Investments, speaking on Bloomberg Television. “I think the Fed will continue to be on hold in December.”

November Gains

Treasuries were steady Friday after slipping Thursday, adding seven basis points to the 10-year yield. That did little to pull back November gains for bonds — both government and corporate — after a jump in the past few weeks. Australian and New Zealand bond yields also gained in Asia.

Crude prices fell even as the OPEC+ group of petroleum producing nations agreed to a supply cutback of about 900,000 barrels a day, in a sign traders are skeptical it will be implemented.

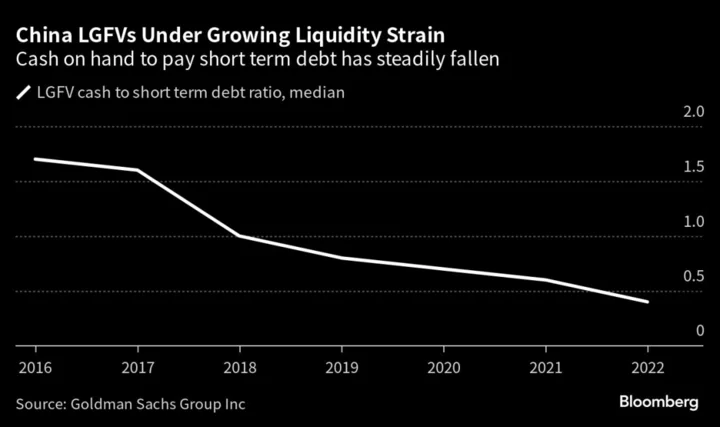

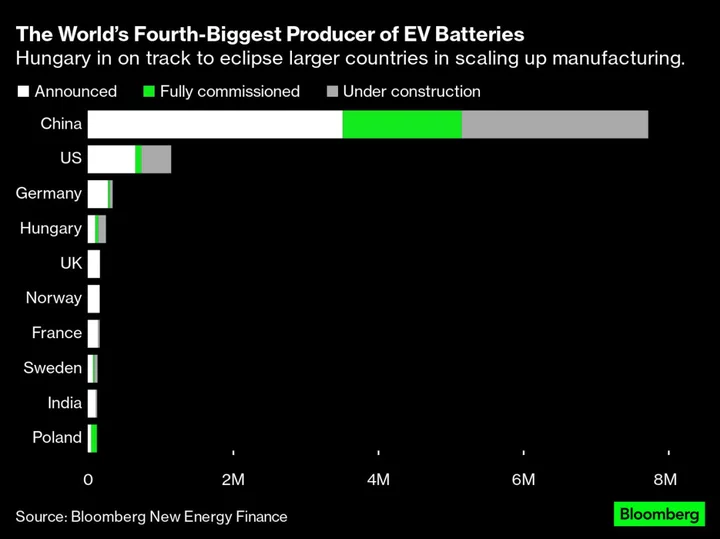

In Asia, PMI data for India, South Korea and Taiwan are set for release, as are the latest inflation reports for Indonesia and Pakistan. Investors will also be looking toward Caixin PMI data for November for China. On Thursday, Treasury Secretary Janet Yellen said the US needs to reduce over-reliance on China in key supply chains, in a further sign of change in the relationship between the world’s two largest economies.

The dollar edged lower Friday, snapping two days of gains and posting its worst month in a year. The yen strengthened against the greenback, however prolonged weakness in the Japanese currency was a driver of life insurers cutting currency hedging by the most in more than a decade.

Gold rose after a decline in the prior session. Bitcoin was little changed at around $37,600.

Elsewhere, the Biden administration has forced a Saudi Aramco venture capital firm to sell its shares in a Silicon Valley AI chip startup backed by OpenAI co-founder Sam Altman. Separately, OpenAI is sticking with a plan to let employees sell shares in the company, according to several people with knowledge of the matter.

Other corporate highlights include Tesla Inc. launching its Cybertruck model after two years of delays. Dell Technologies Inc, meanwhile, reported revenue that declined more than expected, buffeted by continued sluggish corporate demand for personal computers.

Key events this week:

- China Caixin Manufacturing PMI, Friday

- Eurozone S&P Global Manufacturing PMI, Friday

- US construction spending, ISM Manufacturing, Friday

- Fed Chair Jerome Powell to participate in “fireside chat” in Atlanta, Friday

- Chicago Fed President Austan Goolsbee speaks, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures fell 0.1% as of 9:21 a.m. Tokyo time. The S&P 500 rose 0.4% on Friday

- Nasdaq 100 futures fell 0.2%. The Nasdaq 100 fell 0.3%

- Japan’s Topix rose 0.2%

- Australia’s S&P/ASX 200 fell 0.5%

- Euro Stoxx 50 futures rose 0.3%

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro was little changed at $1.0898

- The Japanese yen rose 0.2% to 147.86 per dollar

- The offshore yuan was little changed at 7.1420 per dollar

- The Australian dollar rose 0.1% to $0.6612

Cryptocurrencies

- Bitcoin fell 0.3% to $37,648.5

- Ether rose 0.1% to $2,049.07

Bonds

- The yield on 10-year Treasuries declined two basis points to 4.31%

- Japan’s 10-year yield advanced three basis points to 0.690%

- Australia’s 10-year yield advanced five basis points to 4.46%

Commodities

- West Texas Intermediate crude fell 0.3% to $75.76 a barrel

- Spot gold rose 0.3% to $2,041.93 an ounce

This story was produced with the assistance of Bloomberg Automation.