Asian equity futures showed small gains while contracts for US benchmarks inched higher as investors awaited word from a crucial meeting between President Joe Biden and Republican House Speaker Kevin McCarthy on the debt ceiling.

Stocks in Japan and Hong Kong were poised for early gains Tuesday, with contracts for Australian shares suggesting marginal increases.

That followed fluctuating fortunes in US markets on Monday, with the S&P 500 drifting between gains and losses before closing flat. The tech-heavy Nasdaq 100 advanced 0.3%, though chipmakers were under pressure after China said products by Micron Technology Inc. failed a cybersecurity review.

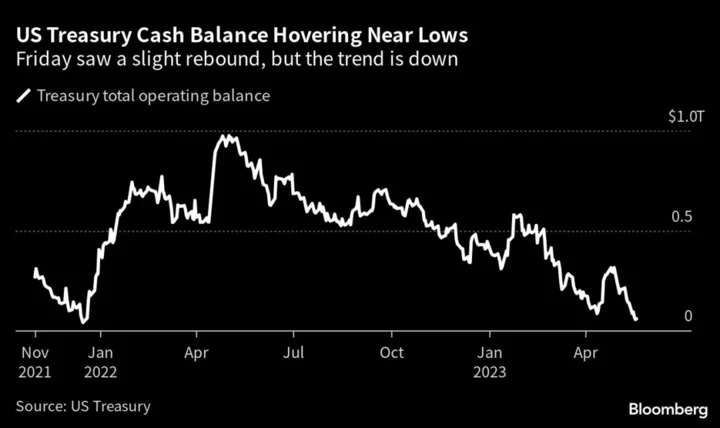

All eyes are on Washington, where the debt talks are underway. Investors hoping to see signs the deadlock between Democrats and Republicans may break as Biden seeks a deal to raise the debt limit before the government runs out of money. Treasury Secretary Janet Yellen said the chances are “quite low” that the US can pay all its bills by mid-June.

“There is a lot of showmanship around the debt ceiling,” said Sarah Hewin, senior economist at Standard Chartered. “The closer we get to June 1 without a resolution, the greater the risk of an accident, so there is a lot of potential for markets to get concerned.”

In Asia, concern is growing about China’s tepid post-pandemic recovery, which is having a negative impact on key commodity prices such as iron ore and copper. Both have both tumbled in recent trading days.

Still, signs of a geopolitical thaw between the regional powerhouse and the US helped lift Hong Kong stocks more than 1% on Monday, with Biden hinting about improving relations with Beijing.

In the US, yields on short-term Treasuries rose and an index of dollar strength eked out a small rise.

The debt ceiling is “all-consuming now,” wrote Chris Low, chief economist at FHN Financial. “But when Congress raises it, attention will return to the economy and the Fed.”

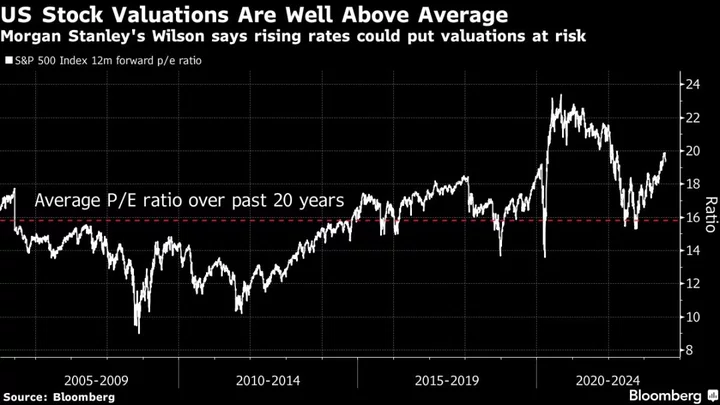

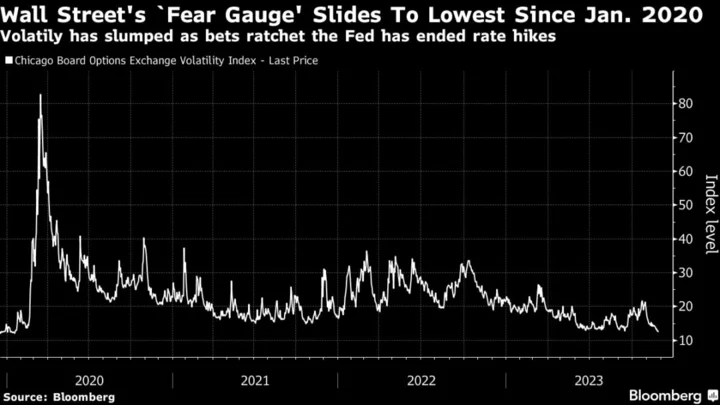

St. Louis Federal Reserve President James Bullard said he’s thinking of two more rate hikes this year, while Minneapolis Fed President Neel Kashkari said if the US central bank pauses next month it should signal tightening isn’t over.

Elsewhere, Greek markets were a bright spot. Sunday’s national election resulted in a strong showing for Prime Minister Kyriakos Mitsotakis, signaling investment-friendly policies can continue. The benchmark Athens Stock Exchange Index jumped to its highest level in almost a decade. Meanwhile, the Euro Stoxx 600 was little changed on the day.

Key events this week:

- Eurozone S&P Global Eurozone Manufacturing & Services PMI, Tuesday

- US new home sales, Tuesday

- Dallas Fed President Lorie Logan speaks, Tuesday

- Fed issues minutes of May 2-3 policy meeting, Wednesday

- Bank of England Governor Andrew Bailey speaks, Wednesday

- US initial jobless claims, GDP, Thursday

- Interest rate decisions in Turkey, South Africa, Indonesia, South Korea, Thursday

- Tokyo CPI, Friday

- US consumer income, wholesale inventories, durable goods, University of Michigan consumer sentiment, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures rose 0.1% as of 7:02 a.m. Tokyo time. The S&P 500 was little changed Monday

- Nasdaq 100 futures rose 0.1%. The Nasdaq 100 rose 0.3%

- Nikkei 225 futures rose 0.5%

- Australia’s S&P/ASX 200 Index futures rose 0.1%

- Hang Seng futures rose 0.3%

Currencies

- The Bloomberg Dollar Spot Index rose 0.1%

- The euro was little changed at $1.0814

- The Japanese yen was little changed at 138.57 per dollar

- The offshore yuan was little changed at 7.0478 per dollar

- The Australian dollar was little changed at $0.6652

Cryptocurrencies

- Bitcoin was little changed at $26,897.69

- Ether rose 0.2% to $1,821.32

Bonds

- The yield on 10-year Treasuries advanced four basis points to 3.71%

Commodities

- West Texas Intermediate crude was little changed

This story was produced with the assistance of Bloomberg Automation.

--With assistance from Emily Graffeo and Vildana Hajric.