An accounting scandal that engulfed Americanas SA last year was deeper than the Brazilian retailer previously reported, according to long-delayed financial reports it released Thursday.

Americanas said the size of the fraud was 25.2 billion reais ($5.2 billion) as of the end of the end of last year — about 5 billion reais more than it previously estimated. The accounting issues stemmed from supply chain financing and false advertising contracts.

The updated figures, published in a filing Thursday, add a layer of complexity to one of Brazil’s largest corporate meltdowns. One of the nation’s largest brick-and-mortar retailers, Americanas sank into bankruptcy protection this year, freezing credit markets and sending shock waves across corporate boardrooms.

By publishing the old earnings, it moves a step closer to negotiating a deal with creditors to rework 42.5 billion reais of debt. An agreement should happen in December, Chief Financial Officer Camille Loyo Faria said in a call with analysts after the release.

In its most recent offer, Americanas proposed swapping bank debt for equity and getting a 12 billion-real capital injection from its largest shareholders.

“Americanas is the biggest interested party in clarifying what really happened,” the company’s management said in the statement. “The numbers of financial statements now reflect the most realistic and transparent figure of the company’s assets and liabilities.”

The retailer posted a loss of 12.9 billion reais ($2.7 billion) in 2022 and 6.2 billion reais in 2021, according to the filing. It said it won’t redo annual figures before 2021 and will re-publish quarterly reports for 2022 along with its 2023 release by year-end.

Shares rose as much as 11% in Sao Paulo to trade at the highest in more than two weeks.

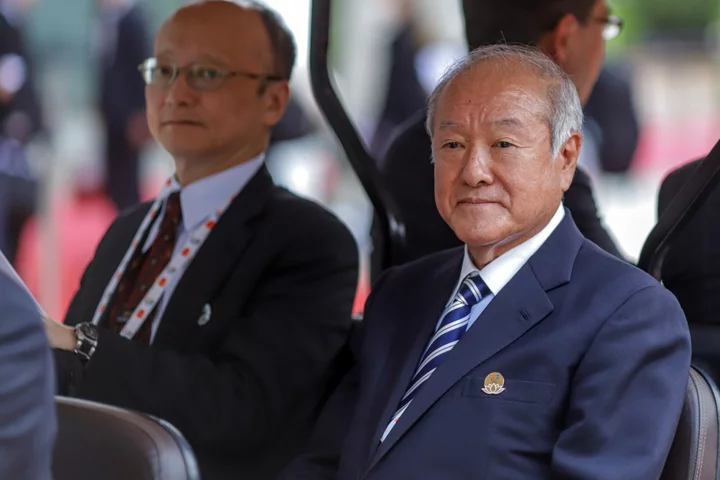

Billionaire Backers

Americanas’ shareholders include some of Brazil’s most-influential business executives, the billionaires Jorge Paulo Lemann, Marcel Telles and Carlos Sicupira, who bought the retailer back in 1982. Its main creditors include Banco Bradesco SA, which holds 4.8 billion reais of debt, Banco Santander SA’s Brazil unit with 3.7 billion reais and Banco BTG Pactual SA with 3.5 billion reais.

The company filed for bankruptcy protection in January after uncovering what it estimated at the time was 20 billion reais of fraud. Its implosion also came as interest rates in Brazil were near 14% which crippled the broader credit market in the country and put a spotlight on other retailers who have struggled under tougher economic conditions.

It marked an abrupt fall for one of Brazil’s most-traditional retailers with roots that date to 1929. Rio de Janeiro-based Americanas, which operates nearly 1,800 stores throughout the country, is known for its emblematic red and white signs, chocolate Easter egg displays and affordable prices for everything from toys to household appliances and books.

Of the billionaire trio, Sicupira has historically been more involved in the company and remains on the board of directors. Newspaper Folha de S. Paulo reported on Oct. 17 that he may put up half of the 12 billion reais with the remainder split between Lemann and Telles. A spokesman for the businessmen declined to comment.

In mid-2022, Americanas announced that former Banco Santander Brasil head Sergio Rial would takeover as chief executive officer on Jan. 1 which was well received by the market. The outgoing CEO, Miguel Gutierrez, had been at the helm for decades.

As the transition neared, Rial said that his access to Gutierrez and the rest of the management team was curtailed along with details of the financial situation. He abruptly resigned just days into the job after uncovering the accounting inconsistencies, which doubled the debt of the firm.

Since then, the retailer has lost millions of clients, closed dozens of stores and cut its work force. While sales on digital platforms have plummeted, customers continue to frequent the physical stores, according to monthly reports.

While details of how the fraud was carried out and how it was hidden for so long remain murky, the Thursday report lays out a path for recovery for the “New Americanas,” according to CFO Loyo Faria and the current CEO Leonardo Coelho.

It plans to cut total debt to as low as 1 billion reais by 2025 and a projected earnings before interest, taxes, depreciation, and amortization of 2.2 billion reais for the full year. The company will have a “significant capitalization” of 24 billion reais in 2024 as part of the funds from shareholders and from the debt overhaul in the judicial recovery process, Loyo Faria said.

Americanas views its fintech AME as part of the firm going forward and will continue to hear offers for its Hortifruti Natural da Terra supermarket chain and retail subsidiary Uni.co, though the divestments are currently on hold, Coelho said on the call.

Once an agreement is reached with banks, it will have to be voted on by a broader group of creditors and taken to the judge overseeing the bankruptcy protection process. It could still take several years to iron out details in order to emerge from the process, according to people involved in the discussions.

In the report, the company said within 90 days of the creditors assembly, it would proceed with payment to suppliers, issuance of new notes as part of the restructuring, proceed with the recapitalization and hold a general shareholders meeting.

“We’ve turned a page today,” Coelho said.

--With assistance from Taís Fuoco.

(Updates with details from earnings starting in first paragraph.)