Aluminum steadied, with traders focusing on a likely shortfall in supply of the metal next year amid constraints on Chinese supply.

The commodity that’s used in everything from soda cans to airplanes earlier Monday rose as much as much as 0.9%, bucking a broader slide among industrial metals. It’s being supported by continued production curbs because of a winter power shortage in China and a capacity ceiling on local smelters, which produce more than half of the world’s supply.

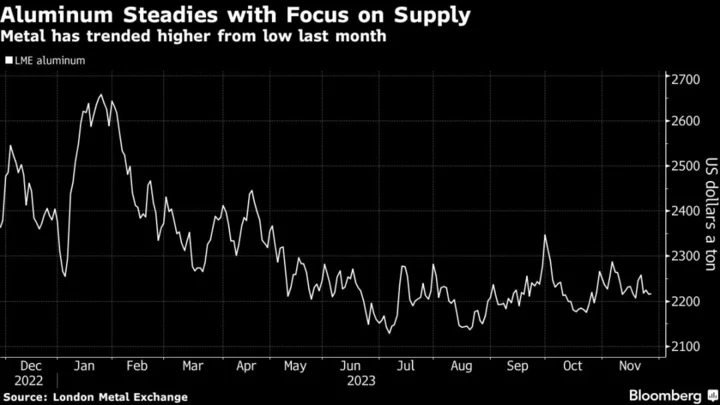

Aluminum has trended tentatively higher since reaching a low last month as China steps up support for its property sector, a globally significant consumer of metals. A weaker dollar, spurred by expectations for looser monetary policy from the Federal Reserve next year, has also provided support.

For aluminum, the tightening outlook mostly reflects “the impact of China’s supply bind, where a combination of hitting the capacity cap and Yunnan winter cuts means that onshore primary production will likely only grow 2% next year,” Goldman Sachs Inc. analysts led by Nicholas Snowdon wrote in a note dated Nov. 26.

The bank sees a global shortage of 1.23 million tons of primary metal next year, almost double the deficit in 2023, with the price rising to $2,600 a ton in 12 months. For now, the aluminum market is signaling plentiful supply in the near term, with spot prices on the London Metal Exchange trading at a discount of more than $40 a ton to benchmark futures.

Aluminum futures added 0.2% to trade at $2,220 a ton on the LME by 10:23 a.m. London time. Zinc rose 0.2%. Other metals were lower, with copper declining 0.5%.