AIA Group Ltd. posted a jump in the value of new business as the exit of Hong Kong and China from pandemic restrictions helped support the insurer’s key gauge of profitability.

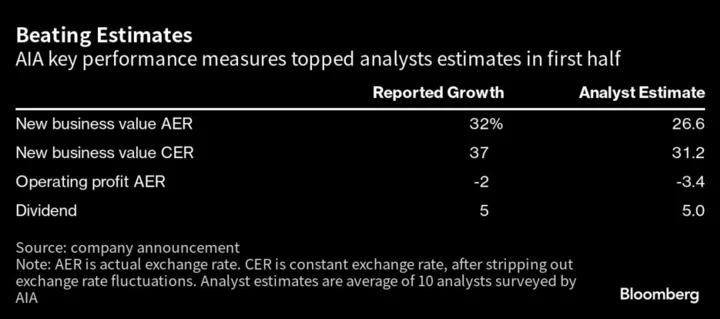

New business value rose 32% in the six months to June 30, the Hong Kong-based insurer said in a statement Thursday. That beat the mean estimate 26.6% of 10 analysts surveyed by the company.

Its Hong Kong unit led the growth, where new business value soared 111% in the first half, as momentum built. It toppled mainland China as its largest new business value contributor during the six months, on strong sales to both local residents and mainland Chinese visitors.

With quarantine-free travel resuming in Hong Kong during the first quarter and visitors starting to return to the city after the Covid-19 shutdowns, sales of insurance products ramped up during the second quarter.

AIA’s mainland China new business value rose 7%. The growth rate from February was 29%, stripping out the currency impact. AIA made a push to grab a share of the country’s private pension market, strong demand for savings type of policies and the low base last year when Shanghai was in its Covid lockdown, Credit Suisse Group AG analysts led by Charles Zhou said in a report earlier this month.

Meantime, in Thailand, new business value grew 26% in the first half. In Singapore it was up 7% and Malaysia clocked a 6% gain over the period. Singapore and Malaysia phased out Covid restrictions earlier and had a higher base of sales in the second quarter of 2022.

Other Key Details:

- Group new business value topped $2 billion in the first half

- Annualized new premiums, which measures new policy sales, rose 43% to nearly $4 billion

- New business margin, new business value as a percentage of annualized new premiums, shrank by 4.4 percentage points to 50.8%

- Operating profit dropped 2.4% in the first half

- The company will pay an interim dividend of 42.29 Hong Kong cents, a 5% increase

In both mainland China and Hong Kong, AIA is seeing an uptick in customer demand for savings-type products, stoking investor concerns over a sustained decline in its new business margin, Goldman Sachs Group Inc. analyst Thomas Wang wrote in a July report. The stocks’s down 19% this year, around twice the decline on the Hang Seng Finance Index of financial firms.

While AIA’s operating profit declined to $3.3 billion, it was up 1% on a per share basis. That was due to investment and currency market volatility, the Goldman Sachs analysts previously wrote. Claims of medical benefits also normalized this year, bouncing back from a year earlier when people were reluctant to visit hospitals amid the Covid outbreaks, the Credit Suisse analysts wrote.

(Updates with details from third paragraph)