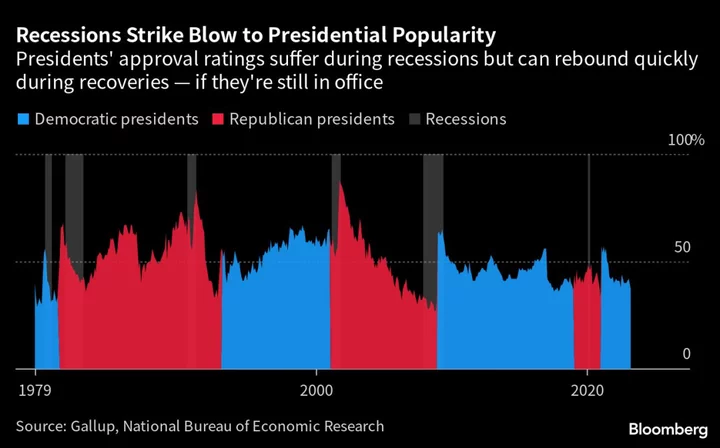

If a recession is going to come in the next 12 months — and most economists surveyed by Bloomberg say it probably is — then President Joe Biden should hope it begins sooner rather than later.

The last three one-term presidents — Jimmy Carter, George H.W. Bush, and Donald Trump — have all had their reelection hopes felled by an economic downturn.

But the list of presidents who survived recessions on their watch is just as long. Richard Nixon, Ronald Reagan and George W. Bush all won reelection — in the first two cases by landslides.

The difference, for the most part, is timing.

Two-term presidents get recessions out of the way early. One-term presidents have bad economic news as voters are deciding.

That means a short recession that begins soon — offering the chance for a rebound by Election Day 2024 — might be the best-case scenario for Democrats.

“The historical record suggests that a recession in the second half of 2023 would probably be less damaging to the president’s reelection prospects than a recession in the first half of 2024,” said Larry Bartels, who studies the intersection of politics and economics at Vanderbilt University. But he also said there’s not much that Biden can do at this point to change the direction of the economy in the short term.

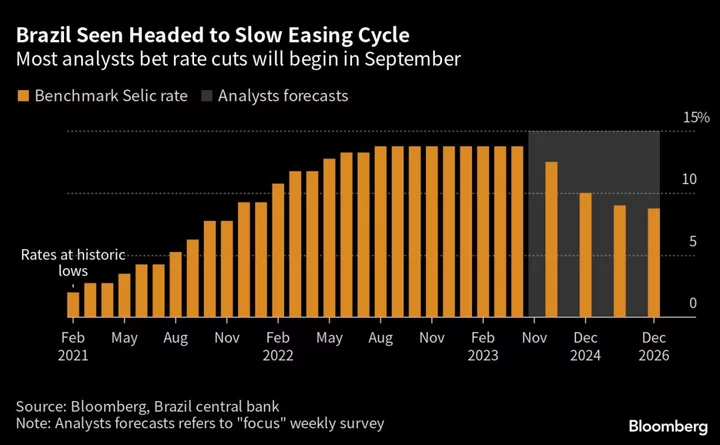

The economic projections accompanying the Federal Reserve’s decision to hold interest rates Wednesday suggest that policymakers see less likelihood of a downturn than before. Officials’ median forecast for gross domestic product growth rose from 0.4% to 1% in 2023, with the expansion expected to pick up slightly in 2024 and 2025.

Bond traders responded to the rate decision with a signal that they’re expecting an increased likelihood of a recession in the next year.

Read more: Treasury Curve Points to Renewed Worries on Fed-Driven Recession

A 65% Chance

The typical modern recession lasts 10 months, so an early, short and shallow recession would give Biden time to regain his economic footing. A late, long and deep recession could put Biden among the list of one-term presidents whose time in the White House was cut short by an untimely slump.

The consensus of economists in a Bloomberg survey shows a 65% chance of a recession in the next 12 months, up from 31% a year ago.

The same survey shows an expectation for a return to modest growth in real gross domestic product next year, with growth approaching 2%. That’s tepid in historical terms, but could be a welcome trajectory for Democrats.

“It’s not the absolute level of the economy. It’s the direction of the economy six months out from the elections that really influences the vote,” said Celinda Lake, who served as Biden’s pollster in 2020.

While they’ve largely directed their fire on each other over social and cultural issues, 2024 Republican presidential candidates have criticized Biden’s stewardship of the economy, blaming him for an inflation rate that in mid-2022 reached 9.1%, its highest point in four decades. But that spike has now ebbed to 4% in data out Tuesday.

Former Vice President Mike Pence mentioned “a looming recession” in his campaign announcement video last week, and former President Donald Trump has asserted for nearly a year that the US is already in a recession.

Biden, for his part, isn’t conceding that a recession is inevitable. “They’ve been telling me since I got elected we’re going to be in a recession,” he said earlier this year.

In a campaign speech to union members in Philadelphia Saturday, Biden touted the progress the economy has made since the pandemic recession, and said legislation on infrastructure, clean energy and semiconductors will help build for the long term.

“The investments we’ve made these past three years have the power to transform this country for the next five decades,” he said. “And guess who’s going to be at the center of that transformation? You.”

White House spokesman Andrew Bates said recession predictions “keep turning out like pollsters’ calls before the midterms: wrong.”

But in a Wall Street Journal op-ed this month, Biden also acknowledged that the US “must look out for risks and guard against them.”

Lake said that’s the right tone. “There was a time in the economic conversation when his optimism seemed out of touch with what’s going on,” she said. “Now he says, ‘I get it. It’s good but it’s not good enough.’”

‘Misery index’

Every recession is different, so it’s hard to know how and when the coming downturn will manifest itself.

What Bloomberg Economics Says:

“We see a mild and relatively short recession unfolding toward the end of Q3 this year. Growth will likely contract in the second half of 2023 — led by a contraction in business investment, while household spending remains slightly positively. The recovery will be tepid in 2024, as still-elevated inflation will keep the Fed from aggressively cutting interest rates as they had in past recessions.”

— Anna Wong, chief US economist.

The misery index, which combines unemployment and inflation, will probably decline by November 2024, said Joel Prakken, co-head of US Economics for S&P Global Market Intelligence. But those numbers alone might not be reflected in voter sentiment.

“Inflation is intolerably high, unemployment unsustainably low,” he said. “This will feel bad, whatever label our profession ultimately attaches to it.”

Political economist Christopher Wlezien of the University of Texas at Austin suggests that voters start to pay attention to the president’s management of the economy after the midterms, effectively giving presidents a two-year pass on the economy they “inherited” from their predecessors.

If that’s the case, Biden is already in the danger zone.

“Voters are myopic,” Wlezien said. “They do not look into the distant past, but they do look fairly far, about two years back.”

--With assistance from Anna Wong (Economist).